10 large caps for good returns in 2021

Investment in market leaders with a safety-first approach could yield reasonable returns across sectors.

Ram Prasad Sahu and Hamsini Karthik report.

A sharp recovery, after the fall in March, helped benchmark indices post their second consecutive double-digit growth of 15 per cent in 2020.

While defensives such as health care and information technology sectors dominated the returns charts, growth became more broad-based towards the second half with cyclicals, too, catching investor attention.

It was not just growth across sectors but down the market capitalisation ladder as well.

After their underperformance over the past couple of years, small and mid cap indices did better than the benchmarks with returns over 20 per cent for the year.

Going ahead, the Street expects strong economic recovery, which is expected to rub off on earnings growth.

In addition to a positive outlook on IT and pharma, analysts expect cyclicals and infrastructure sectors to do well as the capex cycle and investment by the government picks up.

While fund flows continue to be strong, given the sharp rally, investors will have to keep the valuations factor in mind.

With Nifty now trading at 23 per cent premium to the 10-year average, brokerages stress on the need to be selective in the year ahead.

With larger companies gaining market share and the trend expected to be maintained, investment in market leaders with a safety-first approach could yield reasonable returns across sectors.

Also, given multiple levers at their disposal, market leaders are in a better position to absorb the rise in input costs and push up volumes or pass it on to protect margins.

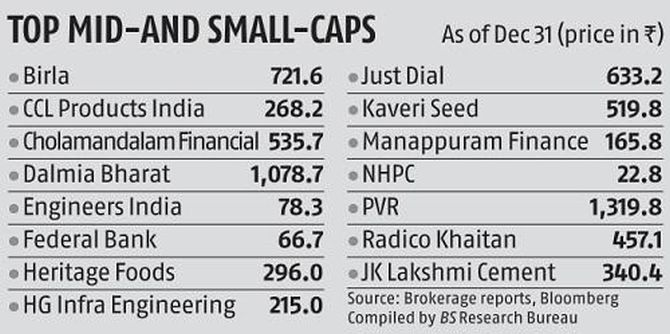

In addition to the most-recommended large caps, we also highlight a few small-caps and mid-caps brokerages included in the portfolios for 2021 due to high growth expectations and attractive valuations.

YTD: Year to date, P/E is price-to-earnings ratio; Data as of December 31, 2020 and compiled by BS Research Bureau; source: Bloomberg estimates, stock picks sourced from ICICI Securities, Angel Broking, HDFC Securities, Credit Suisse, Axis Securities, Nomura, Reliance Securities, BNP Paribas, IIFL Securities, Bernstein, and Motilal Oswal Financial Services; for ICICI Bank, revenue indicates net total income

- MONEY TIPS

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article