Can The Proposed Antibiotic For Multidrug-Resistant Infections Fuel Innoviva's Revenue Growth?

Shares of Innoviva Inc. (INVA), a diversified holding company with a portfolio of royalties and other healthcare assets, have lost nearly 14% of their value year-to-date to trade around $11.

The company’s royalty portfolio is made up of respiratory assets partnered with Glaxo Group Limited including RELVAR/BREO ELLIPTA and ANORO ELLIPTA.

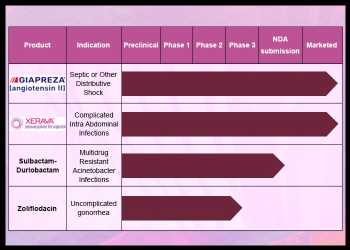

The commercial and marketed products include GIAPREZA approved in the United States to increase blood pressure in adults with septic or other distributive shock, and XERAVA, approved in the U.S. for the treatment of complicated intra-abdominal infections in adults.

The most advanced drug candidate in the company’s pipeline is Sulbactam-durlobactam, being developed for the treatment of adults with hospital-acquired bacterial pneumonia and ventilator-associated bacterial pneumonia caused by susceptible strains of Acinetobacter baumannii-calcoaceticus complex.

Acinetobacter baumannii remains a difficult-to-treat pathogen as it is resistant to penicillins and has also acquired resistance genes for almost all antibiotics. Infections caused by the drug-resistant Acinetobacter are associated with high morbidity and mortality and long, expensive hospital stays.

Sulbactam-durlobactam, came under Innoviva’s fold when it acquired Entasis Therapeutics Holdings while GIAPREZA and XERAVA were obtained through the acquisition of La Jolla Pharmaceutical Company.

The company made two acquisitions last year – Entasis Therapeutics on July 11, 2022, and La Jolla on August 22, 2022.

An FDA panel, which reviewed Sulbactam-durlobactam yesterday, unanimously recommended its approval. The regulatory agency’s final decision is expected on May 29, 2023.

A Look Back At 2022

Net income attributable to Innoviva stockholders declined to $213.9 million or $2.37 per share in 2022 from $265.8 million or $2.87 per share in the prior year.

Total revenue in 2022 was $331.3 million, which included royalty revenue of $311.6 million and net product sales of $19.6 million. This compares with total revenue of $391.8 million in 2021, which consisted only of royalty revenue.

The company ended Dec.31, 2022, with cash and cash equivalents of $291 million.

INVA has traded in a range of $10.64 to $18.55 in the last 1 year. The stock closed Tuesday’s trading at $11.40, down 5.16%.

Source: Read Full Article