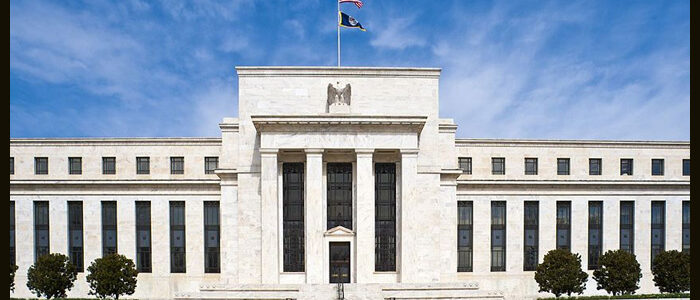

Federal Reserve Raises Interest Rates Another Quarter Point

After pausing its recent series of interest rate hikes last month, the Federal Reserve on Wednesday announced its widely expected decision to resume raising rates.

The Fed said that it has decided to raise the target range for the federal funds rate by 25 basis points to 5.25 to 5.50 percent. With the increase, the midpoint of the target range is the highest since early 2001.

The decision to increase rates came as the Fed noted inflation remains elevated, while U.S. economic activity has been expanding at a moderate pace and job gains have been robust in recent months.

With regard to the outlook for rates, the Fed said, “In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

The central bank said it remains highly attentive to inflation risks and reiterated it is strongly committed to returning inflation to its 2 percent objective.

The Fed’s statement also acknowledged tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation but noted the extent of these effects remains uncertain.

The next monetary policy meeting is scheduled for September 19-20, with CME Group’s FedWatch Tool currently indicating a 79.1 percent chance the Fed will leave rates unchanged.

“The statement left the door open for another rate hike if the data dependent Fed deems it necessary, but the tone of the statement was more neutral rather than decidedly dovish or hawkish,” said Quincy Krosby, Chief Global Strategist for LPL Financial.

She added, “Still, it’s clear that the Fed will raise rates again if the core rate of inflation doesn’t edge lower at a faster pace even if the ‘stickiness’ has begun to untangle.”

In his post-meeting press conference, Fed Chair Jerome Powell said it is possible the central bank could raise rates again in September or hold steady, noting the central bank plans to take a meeting by meeting approach.

“We’re going to be going meeting by meeting and as we go into each meeting, we’re going to be asking ourselves the same questions,” Powell said.

He added, “So we haven’t made any decisions about any future meetings, including the pace at which we consider hiking, but we’re going to be assessing the need for further tightening that may be appropriate.”

At the same time, the Fed Chief said the central bank can “afford to be a little patient” as they assess incoming economic data.

Powell also said policy has not been restrictive enough for long enough to have its full desired effects and noted the Fed plans to keep policy restrictive until it is confident inflation is coming down sustainably to the 2 percent target.

Source: Read Full Article