Global financial warning: China faces ‘tremendous pressure’ – interest rates slashed

Berlin ‘facing dilemma’ over China reveals expert

We use your sign-up to provide content in ways you’ve consented to and to improve our understanding of you. This may include adverts from us and 3rd parties based on our understanding. You can unsubscribe at any time. More info

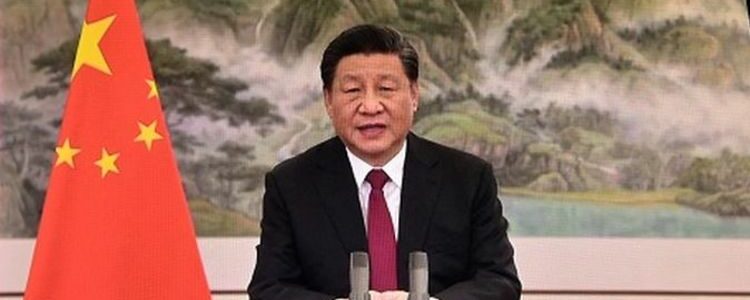

The risks of inflation in particular are surfacing Mr Xi warned, with China facing tremendous pressure. As economies respond to surging prices he warned central banks in the US and Europe to avoid a harsh tightening of policy through interest rate hikes. Speaking at the World Economic Forum’s virtual Davos summit the Chinese president said: “If major economies slam on the brakes or take a U-turn in their monetary policies, there would be serious negative spill-overs. They would present challenges to global economic and financial stability, and developing countries would bear the brunt of it.”

Calling for a co-ordination of economic policy around the world he told the summit governments “need to discard Cold War mentality and seek peaceful co-existence.”

According to Mr Xi such co-ordination is key for global recovery, with a warning that this was essential to prevent the world economy “plummeting again.”

The comments on monetary policy come as China’s central bank has moved to cut interest rates following a slump in GDP growth.

China’s GDP growth for the fourth quarter came in at four percent, down from 4.9 percent in quarter three.

According to Pantheon Macroeconomics, China’s struggling property sector is still a “hefty headwind” to growth with estimates property investment has fallen 17 percent year on year.

Retail figures were also found to have slumped in December to their weakest levels since August 2020.

Victoria Scholar, Head of Investment at Interactive Investor commented: “Beijing’s efforts to reign in China’s overreliance on leverage, the fallout for its property sector and the country’s zero-Covid tolerance policy are all weighing on its growth outlook.

“China’s record trade surplus reported last week for December highlighted the domestic weakness coming through with a sharp slowdown in import growth.

“Today’s retail sales figures paint a similar picture, as weaker consumption suggests China’s economy is bracing for a further slowdown.”

While China is having to relax its monetary policy to prop up growth, the UK has begun embarking on increasing interest rates to bring surging inflation under control.

In the US meanwhile, expectation has grown that the central bank the Federal Reserve will begin raising rates with some banks including Goldman Sachs predicting as many as four hikes this year.

A key difference with China has been the response to Omicron with the UK shying away from greater restrictions while China has seen its commitment to a zero-Covid policy put under pressure by the faster-spreading variant.

The country is continuing to put millions of people into citywide lockdowns to control outbreaks which have taken a major toll on factory and manufacturing output in particular.

DON’T MISS:

Watch out, Tesla! British car firm to rival US giant [FEATURE]

World’s richest men face call for wealth tax [SPOTLIGHT]

Demand for Spanish second homes explodes [LATEST]

Speaking today President Xi acknowledged that both national and international factors had “brought tremendous pressure” on China.

However he remained optimistic for long term growth saying: “The fundamentals of the Chinese economy, characterized by strong resilience, enormous potential and long-term sustainability, remain unchanged.

“We have every confidence in the future of China’s economy.”

Source: Read Full Article