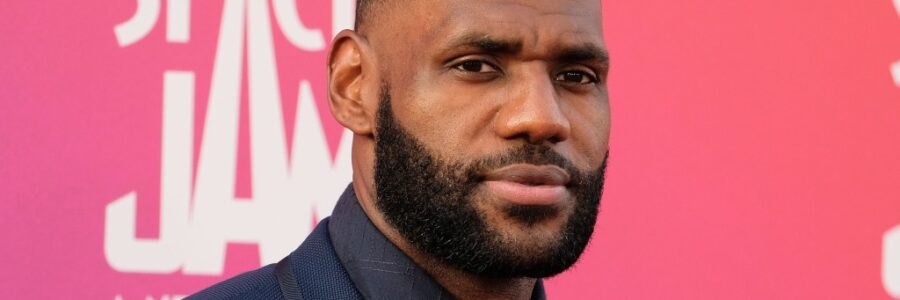

LeBron James’s SpringHill Company Sells “Significant” Minority Stake To RedBird Capital, Fenway Sports, Nike & Epic Games

Capitalizing on a red-hot deal market, LeBron James’s SpringHill Company has sold what it calls a “significant” minority stake to RedBird Capital Partners, Fenway Sports Group, Nike and Epic Games.

The deal values SpringHill at $725 million. Negotiations with a group of investors had been reported over the summer and again in September. Even though his LA Lakers bowed out in the first round of the NBA playoffs last spring, James had a successful outing in July as star and producer of Warner Bros’ Space Jam: A New Legacy.

The new investment will enable SpringHill to expand its existing businesses (IP development, commerce, content, brand consulting and live events) and explore new categories and global markets. The company said it will consider M&A opportunities and connect with the creator community. It plans to build games and other digital experiences, and work with Epic (the privately held game company known for Fortnite) to “bring new content to the metaverse.”

As a part of the transaction, existing shareholder UC Investments will increase its investment. CEO Maverick Carter and James, who is chairman, will still have a controlling interest. Terms were not disclosed.

In addition to Space Jam, SpringHill has backed HBO series The Shop, which is under SpringHill’s Uninterrupted banner designed to empower athletes. It has also set up several Netflix original projects as well as partnerships with major advertisers Procter & Gamble, Chase and PepsiCo, along with Uninterrupted’s own apparel collections.

“SpringHill’s mission is empowering greatness in every individual,” Carter said. “We started this company with the tagline ‘More Than an Athlete,’ which still defines everything we do to this very day. We are an incredible team of athletes, artists, writers, designers, musicians, and countless other creators. With this new group of investors who are the very best in their respective industries we are going to be able to empower our community and every creator to do their most inspiring work and achieve their most ambitious dreams.”

RedBird Capital, which has become a stakeholder in a number of marquee transactions, including one for the YES Network and Dwayne Johnson and Dany Garcia’s purchase of the XFL, is leading the strategic investment.

“Maverick and LeBron have created an impressive media content platform led by a creative leadership team that has built a unique mission-driven brand,” said Gerry Cardinale, the former Goldman Sachs executive who founded and runs RedBird. “Our partnership with SpringHill should enable us collectively to optimize that mission with scalable capital and a business building mentality that will continue to elevate more diverse voices and a drive towards greater empowerment.”

Read More About:

Source: Read Full Article