What Recession? Economy’s Staying Power Poses Big Questions for the Fed

Employers are hiring rapidly. Home prices are rising nationally after months of decline. Consumer spending climbed more than expected in a recent data release.

America’s economy is not experiencing the drastic slowdown that many analysts had expected in light of the Federal Reserve’s 15-month, often aggressive campaign to hit the brakes on growth and bring rapid inflation under control. And that surprising resilience could be either good or bad news.

The economy’s staying power could mean that the Fed will be able to wrangle inflation gently, slowing down price increases without tipping America into any sort of recession. But if companies can continue raising their prices without losing customers amid solid demand, it could keep inflation too hot — forcing consumers to pay more for hotels, food and child care and forcing the Fed to do even more to restrain growth.

Policymakers may need time to figure out which scenario is more likely, so that they can avoid either overreacting and causing unnecessary economic pain or underreacting and allowing rapid inflation to become permanent.

Given that, investors have been betting that Fed officials will skip a rate increase at their June 13-14 meeting before lifting them again in July, proceeding cautiously while emphasizing that pausing does not mean quitting — and that they remain determined to bring prices under control. But even that expectation is increasingly shaky: Markets have spent this week nudging up the probability that the Fed might raise rates at this month’s meeting.

In short, the mixed economic signals could make Fed policy discussions fraught in the months ahead. Here’s where things stand.

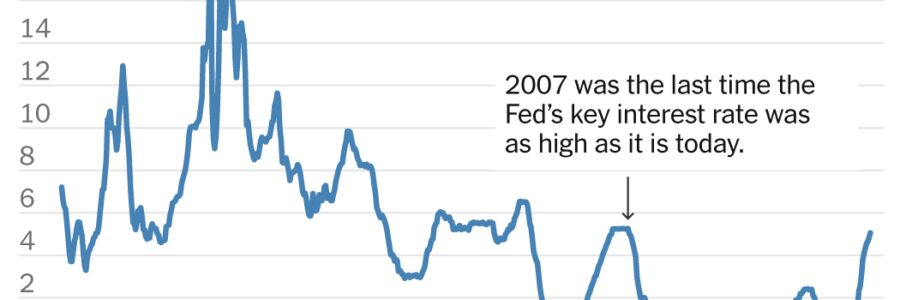

Interest rates are much higher.

Interest rates are above 5 percent, their highest since 2007.

Source: Federal Reserve

By The New York Times

After sharply adjusting policy over the past 15 months, key officials including Jerome H. Powell, the Fed chair, and Philip Jefferson, President Biden’s pick to be the next Fed vice chair, have hinted that central bankers could pause to allow themselves time to judge how the increases are impacting the economy.

But that assessment remains a complex one. Even some parts of the economy that typically slow when the Fed raises rates are demonstrating a surprising ability to withstand today’s interest rates.

“It’s a very complicated, convoluted picture depending on which data points you are looking at,” said Matthew Luzzetti, chief U.S. economist at Deutsche Bank, noting that overall growth figures like gross domestic product have slowed — but other key numbers are holding up.

House prices are wiggling.

Higher interest rates can take months or even years to have their full effect, but they should theoretically work pretty quickly to begin to slow down the car and housing markets, both of which revolve around big purchases made with borrowed cash.

That story has been complicated this time. Car buying has slowed since the Fed started raising rates, but the auto market has been so undersupplied in recent years — thanks in large part to pandemic-tied supply chain problems — that the cool-down has been a bumpy one. Housing has also perplexed some economists.

Note: Data is seasonally adjusted.

Source: S&P CoreLogic Case-Shiller Index, via

S&P Global Intelligence

By The New York Times

The housing market weakened markedly last year as mortgage rates soared. But rates have recently stabilized and home prices have ticked back up amid low inventory. House prices do not count directly in inflation, but their turnaround is a sign that it’s taking a lot to sustainably cool a hot economy.

Job signals are confusing.

Fed officials are also watching for signs that their rate increases are trickling through the economy to slow the job market: As it costs more to fund expansions and as consumer demand slows, companies should pull back on hiring. Amid less competition for workers, wage growth should moderate and unemployment should rise.

Some signs suggest that the chain reaction has begun. People are working fewer hours per week at private employers, which suggests bosses aren’t trying to eke so much out of existing staff.

Notes: Data is seasonally adjusted and includes hours worked by full- and part-time private sector employees.

Source: Bureau of Labor Statistics

By The New York Times

But other signals have been more halting. Job openings had come down, but edged back up in April. Wages have been climbing less swiftly for lower-income workers, but gains remain abnormally rapid. The jobless rate climbed to 3.7 percent in May from 3.4 percent, but even that is still well shy of the 4.5 percent that Fed officials expected it to hit by the end of 2023 in their latest economic forecasts. Officials will release fresh projections next week.

Source: Bureau of Labor Statistics

By The New York Times

And by some measures, the labor market is still chugging. Hiring remains particularly strong.

“Everyone talks as if the economy moves in one straight line,” said Nela Richardson, chief economist at ADP. “In actuality, it’s lumpy.”

Price increases are stubborn.

Still, inflation itself may be the biggest wild card that could shape the Fed’s plans this month and over this summer. Officials forecast in March that annual inflation as measured by the Personal Consumption Expenditures index would retreat to 3.3 percent by the end of the year.

That pullback is gradually happening. Inflation stood at 4.4 percent as of April, down from 7 percent last summer but still more than double the Fed’s 2 percent goal.

Source: Bureau of Economic Analysis

By The New York Times

Officials will receive a related and more up-to-date inflation reading for May — the Consumer Price Index — on the first day of their meeting next week.

Economists expect substantial cooling, which could give officials confidence in pausing rates. But if those forecasts are foiled, it could make for an even more heated debate about what comes next.

Jeanna Smialek writes about the Federal Reserve and the economy for The Times. She previously covered economics at Bloomberg News. @jeannasmialek

Source: Read Full Article