Why won’t the banks issue credit cards to retirees?

I am a 75-year-old retiree who helps seniors with their computers, tablets and laptops. I read your article about banks refusing to issue credit cards to retirees and agree that people need to know about this before they retire. I have been married to the same man for 53 years – my husband is the primary credit card holder and I am a secondary. After I read your column and I discovered I would lose my card if my husband died, I did some research, only to find out that none of the banks were aware of what I was talking about. I found that Australia Post will issue an Everyday Mastercard, whereby you deposit the amount you so desire and use it like a credit card. Please try and let the banks know about this situation as I feel that we are all disadvantaged by this.

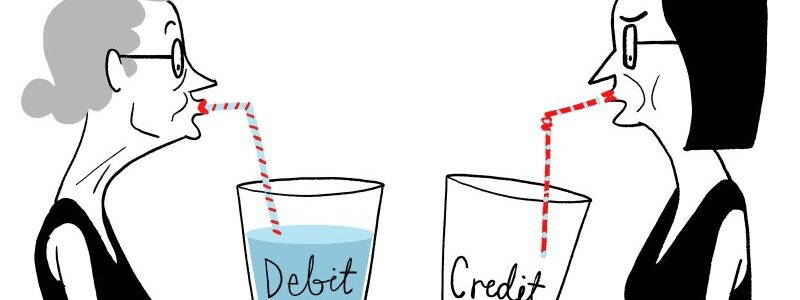

The refusal of banks to issue credit cards to retirees is well-known and becoming a major issue as the population ages. Bank sources tell me confidentially that the banks don’t want the business because they know most retirees will pay well before the due date and the banks would not get any interest. It’s a shameful state of affairs.

The refusal of banks to issue credit cards to retirees is well-known and becoming a major issue as the population ages.Credit:Simon Letch

The MasterCard you mentioned is simply a debit card and most institutions offer them. There are no lending criteria. Having used an ING debit card exclusively for my recent trip to America, I can assure you that arriving home with nothing owing on your credit card is a liberating experience.

I am over 65 and planning to start a superannuation retirement income stream of $30,000 per annum, and I have been advised that the income stream will be tax-free. I currently earn $10,000 per year from investments and shares, for which I currently pay no tax being under the threshold. Once I commence the income stream, will the $30,000 be deemed as income for other purposes by the ATO? In particular, will this mean it may be added to my other $10,000 of income, which may result in me being liable to pay tax on the $10,000?

The tax office does not deem income – your superannuation balance would be deemed for income-test purposes by Centrelink if you are drawing an age pension. Once a person reaches 60, all withdrawals from superannuation are tax-free, and they are not added to your taxable income. This means you should be enjoying a tax-free retirement.

The rate of capital gains tax is the person’s income tax rate. Is this correct? How does it work for people on tax-free retirement super pensions, who don’t pay tax?

Capital gains tax is calculated by adding the net gain, after discount if applicable, to your taxable income in the year of disposal of the asset. If you did have a taxable capital gain, your tax-free pension from your super fund would be disregarded when determining your taxable income and in assessing any capital gains tax.

My dad is receiving an aged pension. He currently has two account-based pensions with a large superannuation fund. One is his own, the other is a reversionary account of my late mother’s. At the time of her passing, we were unaware of the short window within which these two accounts could be consolidated into one. As a result, my father now finds himself paying fees on multiple accounts, and advice from his fund is that these two accounts cannot be merged. Is this correct? Given the changes to the superannuation industry recently and the emphasis placed on Australians having one super account, what, if any, options could you suggest for consolidation? If consolidation is not possible, what options exist as an alternative with a view to minimising fees and not affecting his “assets” as determined by Centrelink?

There is no “window” to consolidate a death benefit pension with any other super accumulation or pension account. Death benefit pensions meet the cashing rules but, unlike other account-based pensions, they cannot be commuted to an accumulation account. This means that they must be kept separate from other types of pension or accumulation accounts. They can, however, be rolled over to another fund as a death benefit pension.

From a Centrelink perspective, all monies in account-based pensions, including death benefit pensions, are counted as assets. This would not change if consolidation was permitted.

- Advice given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. Investors should always seek their own professional advice that takes into account their own personal circumstances before making any financial decisions.

Noel Whittaker is the author of Retirement Made Simple and numerous other books on personal finance. Email: [email protected]

More from Money: How to grow and keep your wealth

- It would be great if the rules of superannuation were simple – but they’re not, and retirees often get confused believing that all withdrawals from super are tax-free. This is how to make your taxable superannuation component tax-free.

- Noel Whittaker answers a reader’s question: Can superannuation be passed onto children tax-free after death? And how do adult children qualify for being considered financially dependent?

- Want to increase your superannuation balance? The rules of superannuation are complex – but this is how best to make additional superannuation contributions before you turn 75.

Most Viewed in Money

From our partners

Source: Read Full Article