5 things to know before the stock market opens Thursday

Here are the most important news, trends and analysis that investors need to start their trading day:

- Stock futures dip, a day after a Wall Street comeback

- Southwest, American shares up after quarterly results

- Credit Suisse announces quarterly loss after Archegos scandal

- Biden pledges sharp reduction in greenhouse gas emissions by 2030

- India reports global record of new single-day Covid cases

1. Stock futures dip, a day after a Wall Street comeback

U.S. stock futures fell slightly Thursday after Wall Street bounced back from a two-session losing streak. The Dow Jones Industrial Average on Wednesday gained 316 points, or 0.9%. The S&P 500 also climbed 0.9% and the Nasdaq jumped 1.2%. The Dow and S&P 500 were fractionally shy of their Friday record high closes. The Nasdaq was 1% away from its February record close. The 10-year Treasury yield, which spiked to 14-month highs in March and dogged tech stocks, ticked higher early Thursday and remained under 1.6%.

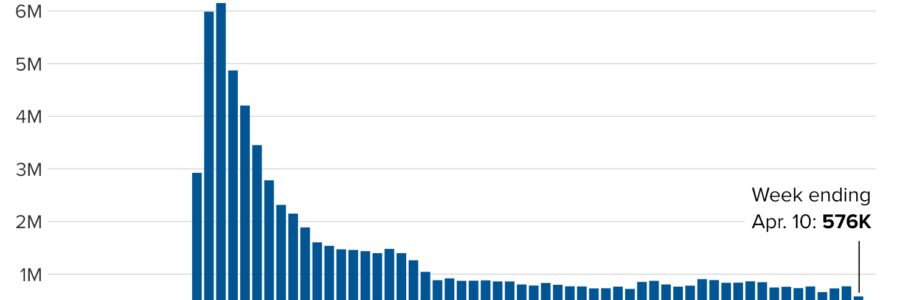

The Labor Department on Thursday reported 547,000 new filings for unemployment benefits during last week, lower than expected and a new Covid pandemic low. The prior week's initial jobless claims were upwardly revised to 586,000, but these are the first readings under 600,000 since the 256,000 reported for the week ending March 14, 2020.

2. Southwest, American shares up after quarterly results

Southwest Airlines said Thursday that leisure travel bookings continue to rise and it expects breakeven cash flow "or better" by June. The Dallas-based airline posted first-quarter net income of $116 million, compared with a $94 million loss a year earlier. Its first-quarter profit was the result of more than $1 billion in federal aid that offset its labor costs. Revenue of $2.1 billion fell nearly 52% from the year-earlier period. Shares rose 2.4% in the premarket.

American Airlines posted a $1.25 billion net loss, its fifth consecutive quarterly loss. The carrier, like its large-carrier rivals Delta and United, has been forced to do without much of the business and international travel revenue they long relied on. American's revenue came in at just over $4 billion, down nearly 53% from the more than $8.5 billion it posted a year ago. Shares jumped roughly 3%.

3. Credit Suisse announces quarterly loss after Archegos scandal

Credit Suisse reported Thursday a net loss of $275 million in the first quarter after warning of heavy losses earlier this month in the meltdown of U.S. hedge fund Archegos Capital. Shares of the Swiss bank that trade on Wall Street fell 5.5% in the premarket. However, the quarterly loss was narrower than expectations. Credit Suisse CEO Thomas Gottstein said that had it not been for Archegos, Q1 would have been "one of our best quarters in the history" of the bank. "Definitely the best quarter in the last 10 years," he told CNBC, while calling the Archegos losses unacceptable.

4. Biden pledges sharp reduction in greenhouse gas emissions by 2030

President Joe Biden is pledging to cut U.S. greenhouse gas emissions in half by 2030, the White House announced ahead of hosting a global climate summit Thursday and Friday. That target roughly doubles America's prior commitment under the 2015 Paris climate agreement. All 40 world leaders Biden invited to the virtual gathering will be attending, including those from China and India. The summit is a chance for the U.S. to rejoin global efforts on climate after the Trump administration exited the Paris accord.

5. India reports global record of new single-day Covid cases

India reported a record number of daily Covid cases Thursday as the country's second wave of coronavirus shows no signs of slowing. There were 314,835 new cases over a 24-hour period. That surpassed the world's previous highest single-day increase held by the United States in January. There's also growing concern about the double mutation of a Covid variant that was discovered in India, which could make the virus more contagious.

India is second to the U.S. in the most cumulative infections — nearly 16 million, roughly half the U.S. total and about 2 million more than No. 3 Brazil. However, unlike India and Brazil, which are in the midst of surges, new daily cases in the U.S. have been trending lower.

— Follow all the market action like a pro on CNBC Pro. Get the latest on the pandemic with CNBC's coronavirus coverage.

Source: Read Full Article