Assets Invested in Smart Beta ETFs and ETPs Listed Globally Reached a Record US$1.22 Trillion at the End of May 2021

By ETFGI

ETFGI, an independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports assets invested in Smart Beta ETFs and ETPs listed globally reached a record US$1.22 trillion at the end of May. Smart Beta ETFs and ETPs listed globally gathered net inflows of US$19.39 billion during May, bringing year-to-date net inflows to US$93.28 billion which is higher than the US$12.99 billion gathered at this point last year. Year-to-date through the end of May 2021, Smart Beta Equity ETF/ETP assets have increased by 3.12% from US$1.19 trillion to US$1.22 trillion, with a 5-year CAGR of 22.8%, according to ETFGI’s May 2021 ETF and ETP Smart Beta industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

-

- Record $1.22 trillion invested in Smart Beta ETFs and ETPs listed globally at end of May.

- Smart Beta ETFs and ETPs listed globally gathered net inflows of $19.39 Bn during May the second highest behind the record $27.92 Bn gathered in March 2021

- Year-to-date net inflows are a record $93.28 billion which is higher than the $12.99 billion gathered at this point in 2020 and the prior record of $40.15 Bn gathered year to date in 2015.

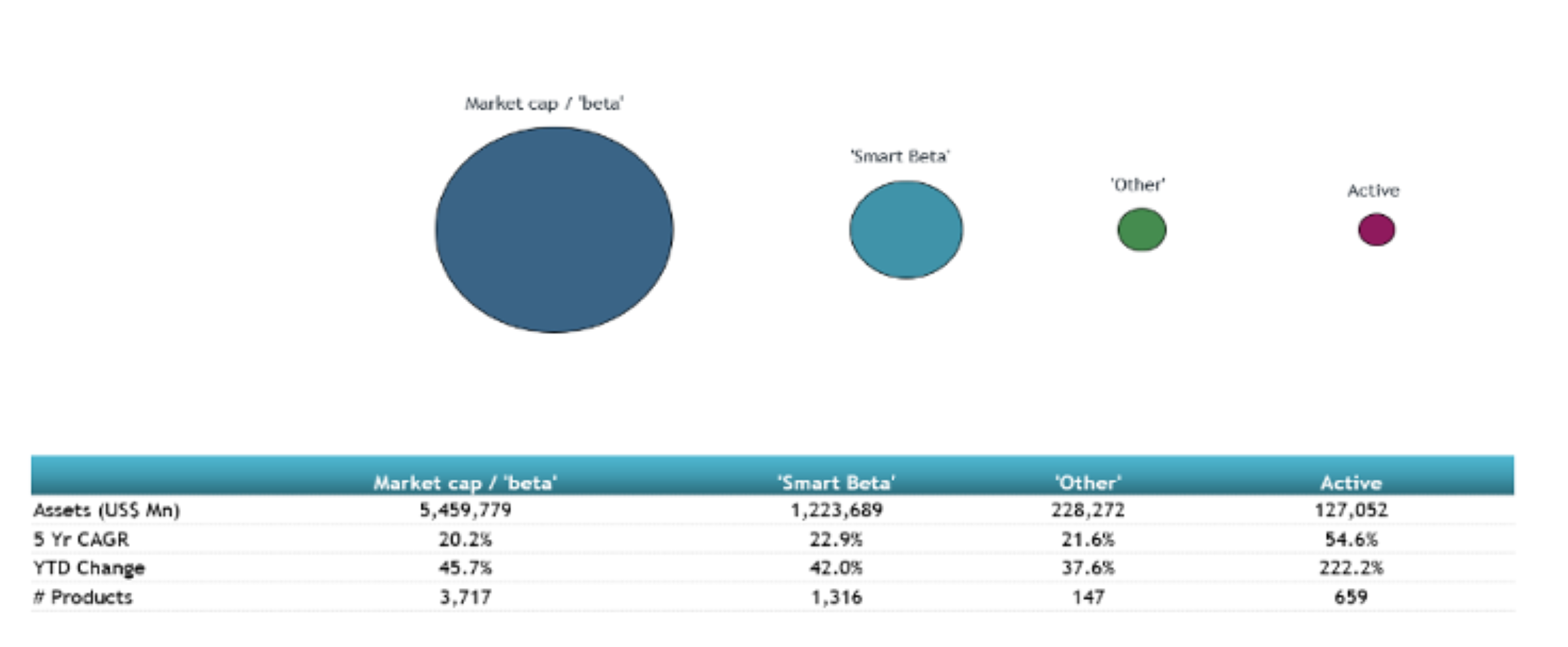

Comparison of Assets in Market Cap, Smart Beta, Other and Active Equity Products

Source: ETFGI

Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources and data generated in-house. Note: This report is based on the most recent data available at the time of publication. Asset and flow data may change slightly as additional data becomes available.

At the end of May 2021, there were 1,316 smart beta equity ETFs/ETPs, with 2,601 listings, assets of $1.22 Tn, from 195 providers listed on 45 exchanges in 37 countries.

Substantial inflows can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $14.17 Bn during May. Vanguard Value ETF (VTV US) gathered the largest net inflows $2.03 Bn.

Top 20 Smart Beta ETFs/ETPs by Net New Assets May 2021

Name Ticker Assets (US$ Mn) May-21 NNA (US$ Mn) YTD-21 NNA (US$ Mn) May-21 Vanguard Value ETF VTV US 81,905.63 8,988.94 2,026.87 Invesco S&P 500 Equal Weight ETF RSP US 28,680.03 6,678.31 1,550.49 Schwab US Dividend Equity ETF SCHD US 25,355.80 5,436.54 989.62 SPDR Portfolio S&P 500 Value ETF SPYV US 12,941.47 3,848.02 985.47 SPDR Portfolio S&P 500 High Dividend ETF SPYD US 4,538.85 1,484.85 918.61 SPDR S&P 400 Mid Cap Value ETF MDYV US 2,440.70 523.83 877.87 Invesco S&P 500 Pure Value ETF RPV US 3,184.73 1,669.42 836.03 iShares MSCI EAFE Value ETF EFV US 14,501.80 5,834.72 727.46 iShares Edge MSCI USA Value Factor UCITS ETF – Acc IUVL LN 6,297.17 3,443.04 666.30 iShares Edge MSCI USA Value Factor ETF VLUE US 16,492.72 4,648.97 653.31 First Trust Rising Dividend Achievers ETF RDVY US 4,485.52 2,052.41 512.61 Vanguard Growth ETF VUG US 73,969.02 977.70 499.81 iShares Edge MSCI Europe Value Factor UCITS ETF IEFV LN 3,690.68 1,354.98 496.12 iShares Edge MSCI World Value Factor UCITS ETF – Acc IWVL LN 6,062.10 2,119.81 443.20 iShares Trust iShares ESG Aware MSCI USA ETF ESGU US 17,363.46 2,283.56 417.28 iShares S&P 500 Value ETF IVE US 23,001.98 1,148.98 339.26 Vanguard Mid-Cap Value ETF VOE US 14,607.63 1,174.33 332.31 Xtrackers S&P 500 Equal Weight UCITS ETF (DR) – 1C – Acc XDEW GY 6,329.47 3,148.72 326.92 JPMorgan US Value Factor ETF JVAL US 1,068.10 925.73 308.39 Yuanta/P-shares Taiwan Dividend Plus ETF 0056 TT 2,788.98 (101.19) 263.62 Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources and data generated in-house. Note: This report is based on the most recent data available at the time of publication. Asset and flow data may change slightly as additional data becomes available.

Please contact [email protected] if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Source: Read Full Article