Earnings Previews: Boeing, General Dynamics, Teck Resources

Before markets opened on Monday, Otis Worldwide beat analysts’ profit estimates while missing on expected revenue. The elevator maker also narrowed its fiscal year earnings per share (EPS) forecast range and lowered its forecast revenue range. Shares traded up about 2.2% shortly after the opening bell.

Activision Blizzard missed on EPS and revenue, but Microsoft still has the $95.00 per share offer on the table so the stock is down less than 1%. Coca-Cola beat both top-line and bottom-line estimates and left its guidance unchanged. The stock was trading up by about 1.8% in the early going Monday.

Before markets open on Tuesday, we shall hear from eight companies we already have previewed. ADM, Corning, D.R. Horton and PepsiCo were covered in one story, and GE, Raytheon, UPS and Valero in another.

Earlier in the morning, we previewed eight companies set to report results after markets close Tuesday: Enphase Energy, GM, QuantumScape and Texas Instruments are in one report, while Alphabet, Chipotle, Microsoft and Visa are in a second.

Here are three firms scheduled to report quarterly results first thing Wednesday morning.

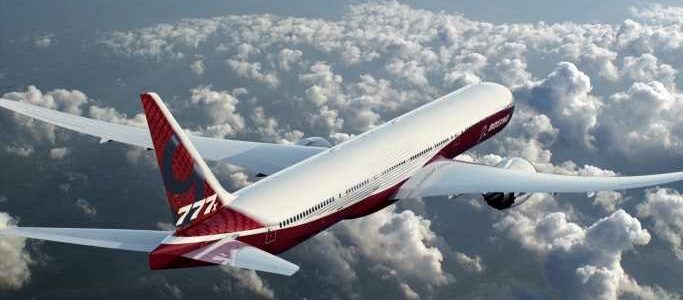

Boeing

Since reaching a 12-month high in early June of last year, shares of Boeing Co. (NYSE: BA) are down by 31.5%. The latest bit of bad news for the Dow Jones industrials company came last Friday when Jon Ostrower reported that Boeing will focus on getting the 737 MAX 10 certified by the December 2022 deadline and put off certification for its 777X widebody until the end of 2024. The original target certification date for the 777X was 2020. Last year, that was pushed out to late 2023.

Boeing delivered 95 commercial jets in the first quarter, up from 77 in the first quarter of 2021. For the same period, rival Airbus delivered 142 this year and 125 last year.

Of 23 analysts covering the stock, 17 have a Buy or Strong Buy rating, while four rate the shares at Hold. At a recent share price of around $174.50, the implied upside based on a median price target of $249.00 is 42.7%. At the high target of $306, the implied upside is about 75.4%.

Consensus estimates call for first-quarter revenue of $16.04 billion, which would be up 8.4% sequentially and about 5.4% higher year over year. Analysts are forecasting a quarterly loss per share of $0.22, compared to a loss of $7.69 per share in the prior quarter and a loss per share of $1.53 last year. For full fiscal 2022, Boeing is expected to post EPS of $3.12, compared to last year’s loss per share of $9.44. Revenue is expected to increase by 28.2% to $79.85 billion.

Boeing stock trades at 56.0 times expected 2022 earnings, 24.7 times estimated 2023 earnings of $7.07 and 19.3 times estimated 2024 earnings of $9.06 per share. The stock’s 52-week range is $167.58 to $258.40. Boeing has suspended its dividend, and total shareholder return for the past year was negative 26.8%.

ALSO READ: Goldman Sachs Pounds Table on Gold as Market Implodes: 8 ‘Strong Buy’ Stocks With Dividends

General Dynamics

General Dynamics Corp. (NYSE: GD) is the country’s third-largest federal contractor and, in 2021, received about 39% of its revenue from its defense programs. That’s far less than top federal contractor Lockheed Martin, which received 66% of total 2021 revenue from its defense business.

Sponsored: Find a Qualified Financial Advisor:

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Source: Read Full Article