Faraday Future Is Said in Talks to Go Public Via SPAC Merger

Faraday & Future Inc., an electric-vehicle startup, is in talks to go public through a merger withProperty Solutions Acquisition Corp., a blank-check firm, according to people with knowledge with the matter.

The special purpose acquisition company is seeking to raise more than $400 million in equity to support the transaction, which is slated to value the combined entity at around $3 billion, the people said. As with all deals that haven’t been finalized, it’s possible that terms change or talks fall apart.

A Faraday spokesman didn’t respond to multiple requests for comment. A Property Solutions representative declined to comment.

Los Angeles-based Faraday, led by Chief Executive Officer Carsten Breitfeld, was founded by Jia Yueting, an entrepreneur who in October 2019 filed for bankruptcy in the U.S. after running up billions of dollars in personal debt trying to build a business empire in China. The company this week appointed Zvi Glasman, the former chief financial officer of Fox Factory Holdings, as its CFO.

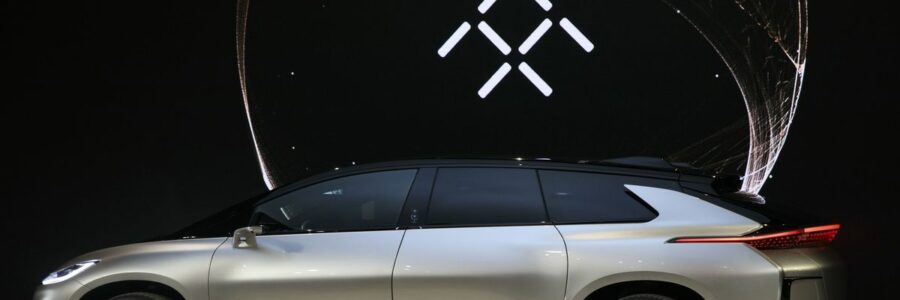

The company has said its flagship vehicle, known as FF 91, will be available for sale about a year after the close of a successful round of funding.

Property Solutions, led by Chairman and co-CEO Jordan Vogel, raised $230 million in a July 2020 initial public offering. The company, which has the ability to pursue a combination in any industry, said at inception that it intended to target firms that service the real estate industry, including property technology.

Electric-vehicle companies including Nikola Corp. and Fisker Inc. have gone public in recent years by merging with blank-check firms.

Source: Read Full Article