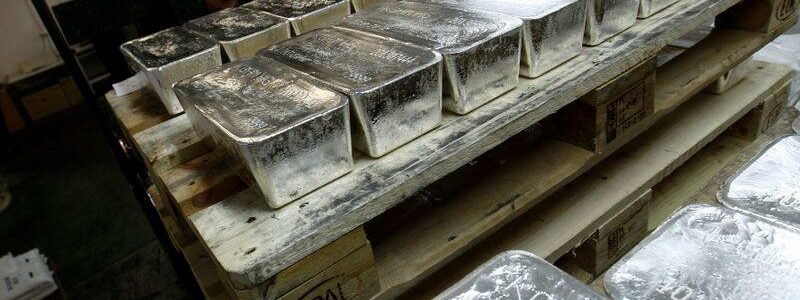

Silver scales 8-year peak as investors keep up feverish buying

(Reuters) – Silver extended its blistering rally for a third session on Monday, soaring as much as 11.2% to a near eight-year peak as retail investors piled into the metal in a frenzy kicked off by U.S. social media users last week.

Spot silver was up 9.4% at $29.53 an ounce by 1418 GMT, having earlier hit its highest since February 2013 at $30.03.

Silver has gained nearly 19% since Thursday when posts began circulating on Reddit urging small investors to buy silver mining stocks and exchange-traded funds (ETF) backed by physical silver bars in a bid to replicate a squeeze on GameStop.

“It’s hard to say how far this can go. It’s all about momentum; if the futures market also gets behind this move, they could add fuel to the fire, so the New York open would be very interesting,” said Ross Norman, an independent analyst.

Commerzbank analyst Eugen Weinberg said in a note that in the medium term, any excessive price rise is harmful for silver as it can damage physical demand.

Silver ETFs and mutual funds saw their biggest inflows in five months in January, Refinitiv Lipper data showed.

Holdings in iShares Silver Trust ETF, the largest silver-backed ETF, jumped by a record 37 million shares from Thursday to Friday alone, each representing an ounce of silver.

Spot gold jumped 1% to $1,864.01 per ounce, while U.S. gold futures rose 0.9% to $1,866.90.

Experts caution that gold’s relatively subdued performance suggests silver’s rally may not last long. An ounce of gold currently buys 63.2 ounces of silver, versus 73.3 ounces on Jan. 25.

The market attention silver is receiving “highlights silver’s historically low price vs. gold”, said Gregor Gregersen, founder of Silver Bullion Pte Ltd, calling the recent retail frenzy a “welcome demand catalyst.”

Platinum gained 3.9% to $1,114.09 and palladium rose 1.4% to $2,256.29.

Source: Read Full Article