Oil Futures Settle Higher Again

Oil prices climbed higher on Wednesday on concerns about trade disruptions due to rising tensions in the Middle East after attacks on vessels in the […]

Continue reading »

Oil prices climbed higher on Wednesday on concerns about trade disruptions due to rising tensions in the Middle East after attacks on vessels in the […]

Continue reading »

BP Plc said it has forfeited a maximum of 32.43 million pounds or $40.59 million in potential remuneration from former CEO Bernard Looney after the […]

Continue reading »

A comprehensive bilateral tax treaty between the United States and Chile entered into force Tuesday. The treaty, ratified by the U.S. Senate in June, was […]

Continue reading »

Meg Hillier grills Sunak on Rwanda spending Rishi Sunak prides himself on mastering the detail. That is how he aims to deal with hostile questions […]

Continue reading »

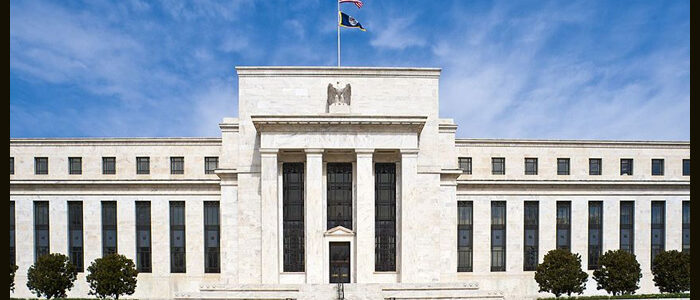

Following a series of interest rate hikes earlier in the year, the Federal Reserve on Wednesday announced its widely expected decision to leave rates unchanged […]

Continue reading »

Nick Robinson erupted at the chief of the doctor’s union in a fiery clash this morning as he questioned planned Christmas and New Year strikes. […]

Continue reading »

Houdini, Inc. is recalling all Wine Country Gift Baskets produced with Quaker Chewy Granola bars that has been recalled recently for potential contamination with Salmonella, […]

Continue reading »

The Bank of Japan maintained its negative interest rate and the yield curve control on Tuesday, and also retained its dovish forward guidance at the […]

Continue reading »

The following are some of the stocks making big moves in Tuesday’s pre-market trading (as of 07.10 A.M. ET). In the Green Infobird Co., Ltd […]

Continue reading »

Jacob Rees-Mogg says Government trans u-turn endangers children Liz Truss has blasted the Government’s new trans guidance, warning it “does not go far enough”, and […]

Continue reading »

Gold futures settled higher on Monday, although the dollar’s rebound from the session’s lows limited the yellow metal’s upside. The dollar was quite sluggish as […]

Continue reading »

Masonite International Corp. (DOOR), a manufacturer of interior and exterior doors and premium door systems, announced Monday a definitive agreement to acquire PGT Innovations, Inc. […]

Continue reading »

Sadiq Khan grilled on police funding by Susan Hall Sadiq Khan’s “mismanagement” of Transport for London (TfL) has meant that the Government has had to […]

Continue reading »

The euro area private sector contracted throughout the second half of the year adding to risk of recession since the third quarter, preliminary results of […]

Continue reading »

In a dazzling resurgence, foreign investors have graced the Indian equity markets with an influx of nearly Rs 1.5 lakh crore in 2023, fuelled by […]

Continue reading »

Rishi Sunak’s “panicking” Conservative Party needs Nigel Farage – but he does not need them, former Tory minister Ann Widdecombe has said. The Prime Minister […]

Continue reading »

One woman drowned and another migrant was rushed to hospital in a critical condition after a dinghy carrying 66 people deflated at around 1am local […]

Continue reading »

The Congress has passed Fiscal 2024 Defense Spending Bill, which authorizes a pay raise for both service members and civilian defense employees, among other things. […]

Continue reading »

Asian stocks ended Friday’s session on a mixed note amid speculation that the Bank of Japan may end its negative interest rate policy as soon […]

Continue reading »

The European Central Bank and the Bank of England are set to leave interest rates unchanged on Thursday after their peer U.S. Federal Reserve left […]

Continue reading »