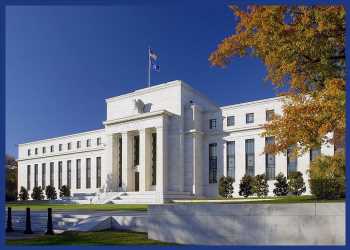

Fed Minutes Reiterate Interest Rate Hikes Coming Soon

The Federal Reserve released the minutes of its January monetary policy meeting Wednesday afternoon, reiterating the view that it would “soon be appropriate” to begin raising interest rates.

The belief that interest rate liftoff should begin soon comes as participants noted that inflation continues to run well above 2 percent and that the labor market has made substantial, broad-based progress over the past year.

The minutes showed participants compared the current situation to the last time the Fed began removing monetary policy accommodation in 2015, determining there is currently a much stronger outlook for growth in economic activity, substantially higher inflation, and a notably tighter labor market

Consequently, most participants suggested that a faster pace of rate increases than in the post-2015 period would likely be warranted, the Fed said.

“But that isn’t saying much,” said Paul Ashworth, Chief U.S. Economist at Capital Economics, who noted a full 12 months elapsed between the first rate hike in December 2015 and the second at the end of 2016.

Participants emphasized that the appropriate path would depend on economic and financial developments and indicated they would be updating their assessments at each meeting.

“Participants noted that the removal of policy accommodation in current circumstances depended on the timing and pace of both increases in the target range of the federal funds rate and the reduction in the size of the Federal Reserve’s balance sheet,” the central bank said.

The Fed added, “In this context, a number of participants commented that conditions would likely warrant beginning to reduce the size of the balance sheet sometime later this year.”

The minutes showed most participants agreed it would be appropriate to remove policy accommodation at a faster pace than currently anticipated if inflation does not move down as expected.

Ashworth said this suggestion is “arguably a little more hawkish” but added, “Still, nothing in the minutes suggests Jim Bullard’s ultra-hawkishness is shared by the majority on the FOMC.”

St. Louis Fed President James Bullard recently indicated he supports raising interest rates by a full percentage point by the start of July and told CNBC he favors front-loading planned interest rate increases

While some participants warned financial conditions might tighten unduly in response to a rapid removal of policy accommodation, a few said the risk could be mitigated through clear and effective communication by the Fed.

The minutes also showed most participants preferred ending the central bank’s asset purchases by early March as planned, although a couple favored ending the purchases sooner to “send an even stronger signal that the Committee was committed to bringing down inflation.”

The Fed’s next monetary policy meeting is scheduled for March 15-16, with CME Group’s FedWatch tool currently indicating a 55.7 percent chance of a 25 basis point rate increase and a 44.3 percent chance of a 50 basis point rate hike.

Source: Read Full Article