Hardly Ever Worn It Adds Premium Service — and Some Polish — to Resale

LONDON — Resale is booming and there are a host of new players to be reckoned with in the market.

Gone are the days when luxury brands rolled their eyes at the secondhand market as another trend that would soon pass, or when consumers were skeptical about buying someone else’s “old” shoes.

In the wake of successful IPOs by ThredUp and Poshmark and Kering’s minority investment in Vestiaire Collective, London-based Hardly Ever Worn It, or HEWI, is looking to grab a bigger slice of the market.

The company is gearing up for a year of “exponential growth,” and is here to add a luxurious point of view and polished flair to the European resale market. It’s in the process of raising series A funding and bringing in a strategic investor, beyond the angel investors who helped to launch the family founded and run business.

HEWI is not new, having been around since 2012. Without much noise or promotion, it has been been growing organically, attracting a dedicated audience of shoppers and sellers with luxury wardrobes and an array of never-worn or hardly worn luxury pieces in need of a new home.

“We knew it was a very good idea from the start: We were moving from the south of France to the U.K., we were going through our wardrobes, deciding what we should and shouldn’t keep and we kept telling each other ‘I’ve hardly ever worn this — sell it,’” said Tatiana Wolter-Ferguson, HEWI’s chief executive officer, who founded the company with her mother, Sharon, and sister, Natalya.

Related Gallery

Fall 2021 Trend: Earth Tones

“The people we had around us were taking storage units, additional home space or even new houses for these wardrobes. It was never stock that was going to end up in a landfill, so we wanted to create this safe space where [members] knew their product would end up with a like-minded individual,” she added.

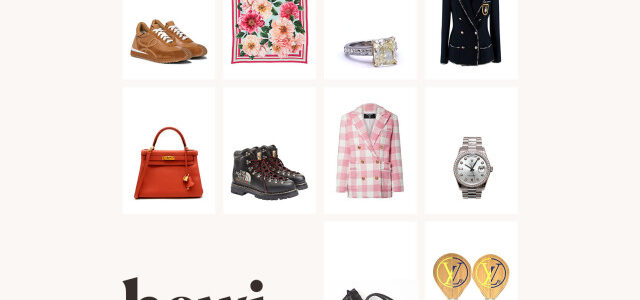

That is just what they did. Right now on HEWI there are items including Balenciaga tailored coats, Loewe bags and Manolo Blahnik pumps, all with a “never worn” tag. High-demand items like Dior saddle bags, Bottega Veneta shoes or Gucci x North Face jackets are also available in what looks like pristine, “hardly every worn” condition, all from the luxury lovers who engage with the site.

Now the company is ready to extend its inner circle and grasp the momentum happening within the resale market.

As well as raising a new funding round, it’s working to refresh its online platform with a focus on personalization. The company is luring industry veterans to its board, including Rachel Reavley, who cut her teeth in magazine publishing and more recently played an instrumental role in growing Threads into the global shopping destination it is today.

“I was so impressed with how organically the business has grown, but also with the kind of polish, the service and the product that’s already on the site,” Reavley said. “In my mind, this feels like the tipping point of the [resale] movement and there’s an opportunity before us for exponential growth.”

For HEWI, this can be achieved by offering the kind of curation and service usually associated with the primary market rather than chasing customer numbers.

“We can really do luxury justice,” Wolter-Ferguson said.

“A lot of our competitors tend to expand their services without keeping their processes tight because they want to go for that mass audience quickly, or they want to reach that unicorn status within the first two years. For us, its very much about finding those sellers, having the best in-house team to curate the offer, and nailing our quality checks. Customers stay with you when they get that level of service. That’s how we see scaling up.”

To date, consignment has been seen by many as a destination for younger or entry-level shoppers who are unable to afford luxury on the primary market. But HEWI believes the audience is more varied, and is looking to close the gap between secondhand sellers and shoppers and lure sought-after VIP shoppers into the consignment game.

Indeed, the company knows its audience and the value of the products it’s selling. At a steep discount, secondhand products still come at a premium — be it a 4,000 pound Chanel bag or 600 pound Louis Vuitton Archlight sneakers — so it is committed to treating its buyers, and sellers, as luxury customers.

“You’re still buying something on the site that may be between 500 [pounds] and 6,000 pounds — I feel like sometimes people lose sight of that. This is still a marketplace that very much sits in the luxury space. The people who do get pleasure out of luxury are used to being serviced in particular ways and to a certain level of respect for the brands and products,” explained Reavley.

Wolter-Ferguson added the site’s customer base includes a broad range of 25- to 55-year-olds and is primarily aimed at “engaged” luxury shoppers who enjoy spending in a Chanel or Hermès boutique just as much as they do hunting for a piece they couldn’t get access to when it first hit stores.

“You could be based in London and spot a Chanel item you’ve never seen before, because it was only stocked at their Dubai locations,” she explained.

Post-pandemic attitudes around sustainable consumption are only driving those high-end shoppers closer to secondhand buying — because ultimately it means they can continue getting their luxury fix “guilt-free.”

“It’s a change in status quo. You can almost look back at it now and laugh about how could you be building these beautiful creative products that can last 100 years and expect them to only have one owner?” Reavly added.

“There’s a lot of fluidity around ownership: We’ve seen that shift happen in housing, in car rental, in so many industries. Why wouldn’t we be applying that same attitude to fashion?”

When it comes to working directly with brands versus sellers, HEWI is steering with caution, despite brands becoming more eager to embrace the secondhand market post-pandemic.

“We’ve never really felt comfortable with brands offloading end-of-line stock on our site, there’s a lot of other places you can do that. The other method [of working with brands] is having customers receive credit to spend in-store, but again our customers don’t want to be told where to spend their money. So it’s about finding the best method for us,” Wolter-Ferguson said.

Instead, the business is staying focused on the launch of its new platform this summer, which will offer personalized recommendations based on sizing or favorite brands, as well as a wider range of VIP services for top sellers and buyers.

“It’s not about gimmicks or what AI can deliver for us. The opportunity here is to build the service proposition. It’s all about that ease of transaction and those things that don’t sound ultimately very sexy but take all the fatigue out of online shopping. Whether you need sizing advice or are looking to understand how one brand’s sizing varies from the other, we’re doing all that back-of-house to make the process seamless,” Reavley said.

“That is where this market will really accelerate because once you’ve had that kind of service, it will change your customer expectation and then there will be no going back. The vision is to change customers’ behavior so much so that HEWI becomes the first destination they go to, before looking on the primary market,” she added.

Source: Read Full Article