S’pore’s private sector heeds call for green finance growth

As Singapore works to overcome Covid-19, another burning existential crisis looms — climate change.

In the last few months alone, Singapore has broken at least two weather records. It faced its driest February since 2014 and its highest daily rainfall for April since 1980. The latter triggered flash floods in several parts of the island.

Confronted by worsening climate change, investors around the world are pivoting towards a focus on environmental, social and governance (ESG) factors.

In Singapore, the Government is leading the charge with the Singapore Green Plan 2030. Launched in February, the whole-of-nation plan charts the country’s path towards a more sustainable future over the next decade. A key pillar of this national agenda is to build a green economy with an array of initiatives and targets in green finance, most notably to transform Singapore into a green finance hub for the region.

This move builds on the foundations of the Monetary Authority of Singapore’s (MAS) Green Finance Action Plan which was introduced in 2019 — to strengthen the financial sector’s resilience to environmental risks, develop green financial solutions, and leverage innovation and technology.

To fuel its transition towards a green finance hub, the Government announced in this year’s Budget that it plans to issue green bonds worth $19 billion to pay for public sector infrastructure projects. Green bonds fund projects that have a positive environmental impact.

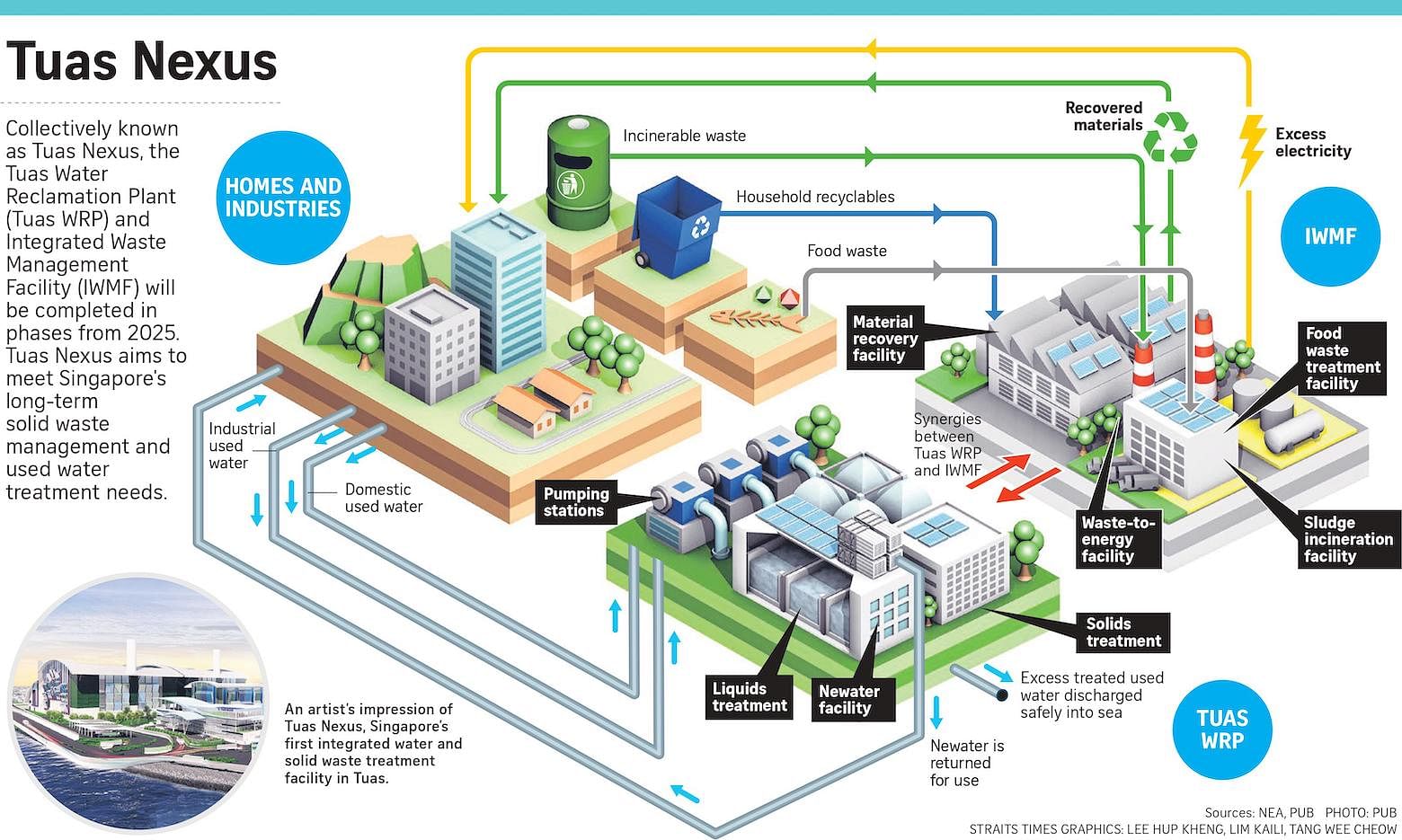

One of the projects that will be financed with green bonds is Tuas Nexus, Singapore’s first integrated water and solid waste treatment facility in Tuas which is slated for completion in 2025.

What is encouraging is that more in the financial sector are heeding the call. They see the benefits of investing in ESG.

“Large asset owners in Asia, including pension funds and insurance companies, have made their own commitments to prioritising sustainability, and some have also made net-zero commitments,” says Mr Victor Wong, head of UOB Asset Management (UOBAM) sustainability office.

He adds that investment managers are also banking on the benefits of ESG investing by allocating capital sustainably to create long-term value for investors, enabling them to invest for both profit and purpose.

Digital wealth adviser Endowus is actively seizing the initiative as the first in Singapore to allow retail investors to participate by using their Central Provident Fund Ordinary account savings and the Supplementary Retirement Scheme, as well as their normal cash savings.

In March, Endowus launched multi-asset ESG investing portfolios — developed through comprehensive due diligence reviews to identify best-in-class funds with strong ESG profiles.

The firm increases the potential returns for investors by cutting out trailer fees, a commission paid by fund managers to financial advisers, brokers, private banks, and investment platforms for selling their products.

Mr Sam Rhee, chairman and chief investment officer at Endowus has noticed a greater awareness and preference for ESG investing through surveys conducted by the firm, as well as client interactions.

With this, Mr Rhee emphasizes the importance of investing wisely and avoiding companies that engage in “greenwashing” — the exaggeration of sustainability claims to entice investors.

“It’s important to be able to invest efficiently in great companies that adopt sustainability and ESG practices and this will lead to good returns over the long run for investors,” he says.

“Of course, there are concerns of greenwashing, but that is why a trusted advisor is needed to separate the wheat from the chaff and make sure only the highest quality investment options are made available.”

Deeper shades of green

More than a rescue plan for the planet, green finance may also present opportunities for financial markets to become more sustainable and stable.

In a speech at the 2019 Singapore FinTech Festival, Transport Minister Ong Ye Kung, who becomes Health Minister from Friday, said that over the last 30 years, the annual average worldwide cost of natural disasters was US$140 billion (S$186 billion). Within the last decade, seven out of 10 years have exceeded this average.

Mr Ong, who was then the Education Minister, added: “At a temperature rise of two deg C, US$1.7 trillion (S$2.3 trillion) of global financial assets or about two per cent of today’s global GDP are estimated to be at risk.”

Mr Gregory Van, chief executive officer of Endowus shares that the financial sector plays an important role in mitigating climate change, by re-directing capital to promote and accelerate the development of sustainable solutions.

“In the near-term, the Government is providing the impetus, but as we’ve already seen in other developed markets, the inherent benefits of green finance for both investors and society (better performance and a better future) will be what provides the ongoing momentum.”

These include realigning investments to avoid at-risk assets and supporting innovative projects and companies that are adapting to the need for sustainable developments while reducing the tail risk of the investment.

Mr Van adds that terms like “green bonds” and “green finance” would eventually become obsolete as sustainability becomes a fundamental component of all investment decision-making.

Under Singapore’s Green Finance Action Plan framework, the MAS will launch a US$2 billion (S$2.7 billion) Green Investments Programme to invest in funds that have a strong green focus in their investment strategies. It will also work with asset managers committed to deepening finance activities and capabilities in Singapore.

Coupled with the Government’s issuance of green bonds, this programme could help to cement the country’s role as a nexus for infrastructure financing. Such efforts place Singapore more firmly at the centre of green finance in Asia by increasing her competitiveness and investment attractiveness, with potential to deepen market liquidity for green bonds.

These efforts have “catalysed the adoption of sustainability practices” by many Asian companies, according to Mr Thio Boon Kiat, chief executive officer of UOBAM.

He adds that such companies “have realised that sustainable investing also drives long-term financial performance while simultaneously creating a positive impact on the environment and society.”

Journey to sustainability

A look at the Government’s efforts in tackling climate change through green finance.

2017

MAS launches Green Bond Grant Scheme to promote the issuance of green bonds

2018

Singapore designates 2018 as the Year of Climate Action to raise national awareness of climate change

2019

The Green Bond Grant Scheme is renamed the Sustainable Bond Grant Scheme. To support more issuers, the minimum issuance size is lowered from $200 million to $20 million

MAS launches Green Finance Action Plan, followed by a US$2 billion (S$2.7 billion) Green Investments Programme.

2020

MAS launches Green and Sustainability-Linked Loan Grant Scheme to support companies in green and sustainable finance. The scope of the Sustainable Bond Grant Scheme is expanded to include sustainability-linked bonds

MAS launches Project Greenprint, a technology platform to promote a green financial ecosystem, and the Singapore Green Finance Centre, the nation’s first research institute dedicated to green finance research and talent development

2021

MAS’ Green Finance Industry Taskforce launches an environmental risk management handbook to support green finance

Govt announces plans to issue green bonds to fund up to $19 billion of public sector green projects

Ask an expert

Keen on ESG investing but want to know more? Send your questions to [email protected]

May 23: An investment expert answers your questions on the ins and outs of investing in green finance

Green finance can help to put the brakes on climate change. Start your journey with Endowus here.

This article is the second instalment of “Invest in Impact”, a three-part series by Endowus on ESG investing. Read the first part here.

Brought to you by Endowus and UOB Asset Management

Investment involves risk. As such, the capital value of investments and the income from them may go down as well as up and may become valueless. You should carefully consider whether any investment views and products/services are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances or seek financial advice via Endowus’ platform. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Join ST’s Telegram channel here and get the latest breaking news delivered to you.

Source: Read Full Article