U.S. Consumer Confidence Holds Steady In May

A report released by the Conference Board on Tuesday showed consumer confidence in the U.S. held steady in the month of May.

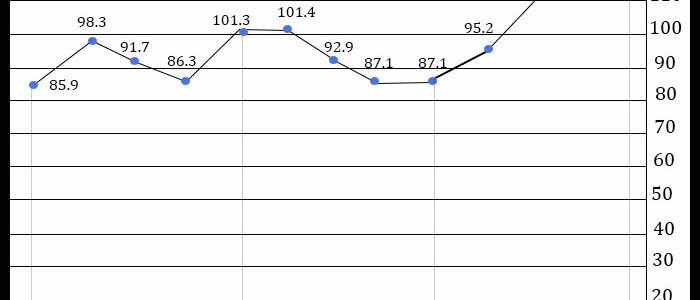

The Conference Board said its consumer confidence index edged down to 117.2 in May after climbing to a revised 117.5 in April.

Economists had expected the consumer confidence index to pull back to 119.5 from the 121.7 originally reported for the previous month.

“After rebounding sharply in recent months, U.S. consumer confidence was essentially unchanged in May,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board.

She added, “Overall, consumers remain optimistic, and confidence should remain resilient in the short term, as vaccination rates climb, COVID-19 cases decline further, and the economy fully reopens.”

Reflecting consumers’ improved appraisal of current conditions, the present situation index jumped to 144.3 in May from 131.9 in April.

While the percentage of consumers claiming business conditions are “good” fell to 18.7 percent from 19.4 percent, the proportion claiming conditions are “bad” also slid to 21.8 percent from 24.5 percent.

Consumers’ assessment of the labor market also improved, as those saying jobs are “plentiful” spiked to 46.8 percent from 36.3 percent and those claiming jobs are “hard to get” dipped to 12.2 percent from 14.7 percent.

Meanwhile, the Conference Board said the expectations index dropped to 99.1 in May from 107.9 in April, as consumers’ optimism about the short-term outlook waned.

The percentage of consumers expecting business conditions to improve over the next six months slipped to 30.3 percent from 33.1 percent, while the proportion expecting conditions to worsen rose to 14.8 percent from 12.1 percent.

Consumers were also less upbeat about the job market, with those expecting more jobs in the months ahead slumping to 27.2 percent from 31.7 percent and those anticipating fewer jobs climbing to 17.3 percent from 14.4 percent.

“Consumers were also less upbeat this month about their income prospects—a reflection, perhaps, of both rising inflation expectations and a waning of further government support until expanded Child Tax Credit payments begin reaching parents in July,” Franco said.

The report said 14.5 percent of consumers expect their incomes to increase in the next six months, down from 17.4 percent in April. The proportion expecting their incomes to decrease also fell to 9.3 percent from 10.5 percent.

On Friday, the University of Michigan is scheduled to release its final reading on consumer sentiment in the month of May.

The consumer sentiment index for May is currently expected to be upwardly revised to 82.9 from the preliminary reading of 82.8, which was down from 88.3 in April.

Source: Read Full Article