U.S. Consumer Confidence Shows Modest Deterioration In February

Reflecting a deterioration in consumer expectations, the Conference Board released a report on Tuesday showing a modest decrease in U.S. consumer confidence in the month of February.

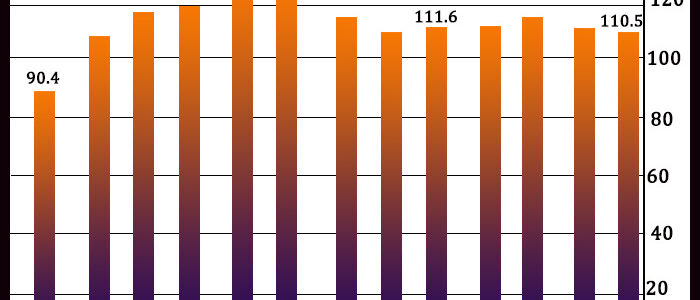

The Conference Board said its consumer confidence index dipped to 110.5 in February from a downwardly revised 111.1 in January.

Economists had expected the consumer confidence index to drop to 110.0 from the 113.8 originally reported for the previous month.

“Concerns about inflation rose again in February, after posting back-to-back declines,” said Lynn Franco, Senior Director of Economic Indicators at the Conference Board. “Despite this reversal, consumers remain relatively confident about short-term growth prospects.”

“While they do not expect the economy to pick up steam in the near future, they also do not foresee conditions worsening,” she added. “Nevertheless, confidence and consumer spending will continue to face headwinds from rising prices in the coming months.”

The modest decrease by the consumer confidence index came as the expectations index slipped to 87.5 in February from 88.8 in January.

Consumers expecting business conditions to improve edged down to 23.4 percent from 23.6 percent, although those expecting conditions to worsen also fell to 18.1 percent from 19.7 percent.

The Conference Board said consumers were also less optimistic about the short-term labor market outlook.

The percentage of consumers expecting more jobs in the months ahead dipped to 21.3 percent from 22.1 percent, while those expecting fewer jobs rose to 17.9 percent from 16.6 percent.

Meanwhile, the report showed the present situation index inched up to 145.1 in February from 144.5 in January.

Consumers describing current business conditions as “good” fell to 18.7 percent from 20.0 percent, but those saying conditions are “bad” also slid to 24.7 percent from 27.4 percent.

The assessment of the labor market was also mixed, as consumers saying jobs were “plentiful” slipped to 53.8 percent from 55.0 percent, while those saying jobs are “hard to get” edged down to 11.8 percent from 12.0 percent.

“It remains doubtful that consumer attitudes will experience a material improvement until inflation dynamics start to normalize in Q2,” said Mahir Rasheed, U.S. Economist at Oxford Economics.

He added, “In the meantime, geopolitical tensions in Europe will keep uncertainty elevated while price increases continue to outpace wage growth and erode household purchasing power.”

Source: Read Full Article