U.S. Consumer Price Growth Slows More Than Expected In October

The Labor Department released a highly anticipated report on Thursday showing U.S. consumer prices increased by less than expected in the month of October.

The report showed the consumer price index rose by 0.4 percent in October, matching the increase seen in September. Economists had expected consumer prices to climb by 0.6 percent.

The annual rate of growth in consumer prices slowed to 7.7 percent in October from 8.2 percent in September. The year-over-year increase was the smallest since January and came in below estimates for an 8.0 percent jump.

“Evidence is accumulating that inflation has peaked and is now falling again,” said Dr. Christoph Balz and Bernd Weidensteiner, senior economists at Commerzbank. “The Fed’s next rate hike is therefore likely to be smaller.”

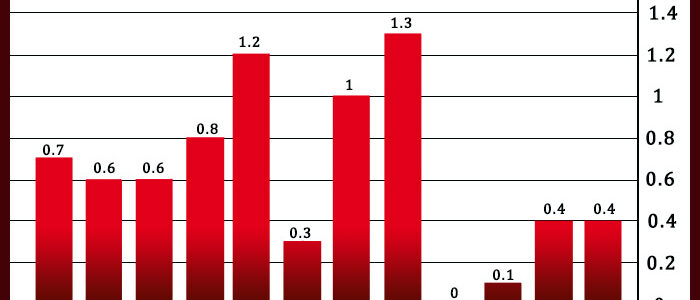

The monthly price growth largely reflected a 0.8 percent advance in prices for shelter, which represents the biggest monthly increase since August 1990.

The Labor Department said the rent index climbed by 0.7 percent, while the owners’ equivalent rent index rose by 0.6 percent. The index for lodging away from home spiked 4.9 percent in October.

The report also showed energy prices jumped by 1.8 percent in October after falling sharply over the three previous months. Food prices also rose by 0.6 percent, although prices for food at home saw the smallest monthly increase since last December.

The Labor Department also said core consumer prices, which exclude food and energy prices, edged up by 0.3 percent in October after advancing by 0.6 percent in September. Economists had expected core prices to rise by 0.5 percent.

The annual rate of growth in core prices slowed to 6.3 percent in October from 6.6 percent in September, coming in below estimates for 6.5 percent growth.

The monthly core price growth reflected the increase in prices for shelter as well as higher prices for motor vehicle insurance, recreation, new vehicles, and personal care.

Meanwhile, decreases in prices for used cars and trucks, medical care, apparel, and airline fares helped limit the upside.

Source: Read Full Article