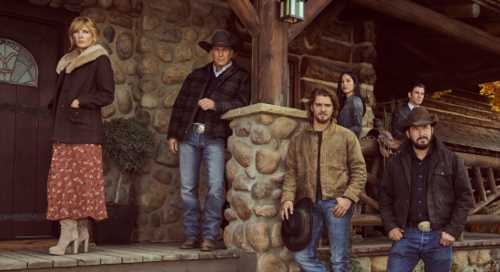

‘Yellowstone’-Style Licensing Deals To Rival Streamers Are No Longer In Paramount’s Forecast, CFO Naveen Chopra Confirms

The strategy to license Yellowstone and other major properties to rival streaming services like Peacock and HBO Max, which Paramount Global CEO Bob Bakish has called “unfortunate,” is out the window, according to CFO Naveen Chopra.

“We’re no longer licensing big, franchise IP to third parties. Back in the day when Paramount didn’t have its own streaming service, that was the best way to monetize content,” Chopra said during an appearance today at MoffettNathanson’s 9th annual Media and Communications Summit. “Today, that doesn’t necessarily make sense. As some of those things come up, we’ll keep them for our owned and operated platform.”

Moderator Michael Nathanson cited heavy viewing on Netflix of Paramount shows like NCIS, wondering if that would persuade the company to continue selling off those rights. In answering, Chopra didn’t bring up any specific shows. He joined the company, then known as ViacomCBS, in August 2020, after a large licensing deal was made with NBCUniversal for Yellowstone, and another one for South Park on HBO Max. Before the expansion and rebranding of streaming service Paramount+ in 2021, the company had tended to operate as an “arms dealer,” capitalizing on surging buy-side demand for film and TV content.

Related Story

'Yellowstone' Season 5 Premiere Date: Kevin Costner Series Returns To Paramount Network In The Fall

The other significant shift in strategy, Chopra noted, is a reduction in production by Paramount for third-party distributors. “The reality is, that’s a pretty low-margin business anyway. It doesn’t make sense strategically to enable our competitors with that content.”

Apart from occasional one-off opportunities to produce for others, Chopra said the company would see a “huge strategic benefit in dialing that back,” mainly because the working capital required to fund that production could be deployed for internal purposes.

Asked about Warren Buffett’s Berkshire Hathaway recently taking a $2.6 billion stake in Paramount, Chopra said it was an “exciting” development. Since the investment was revealed on Tuesday, Paramount shares have risen 14%. In Chopra’s view, the validation from Buffett affirms the Paramount strategy of blending emerging assets like streaming with more mature, but still lucrative businesses like linear TV and theatrical film distribution.

“Until very recently, the conventional wisdom was, ‘All these traditional legacy assets are just a boat anchor to growing in streaming and shed them as quickly as possible and be all-in on streaming,’” the CFO said. “What everybody is recognizing now is that, no, those assets are actually the things that will allow you to build a streaming business that can actually generate profits and create value. And we’re pressing our advantage on that.”

Must Read Stories

‘Riverdale’ To End; Fall Sked Set; ‘Babylon 5’; Pedowitz On “Shock” Of Cancellations

‘Squid Game’ Creator Hwang Dong-hyuk Developing Satire Based On His Show’s Success

LA Screenings Returns: Studios Set Slates As Buyers Seek Certainty

Serebrennikov Defends Abramovich; Black Bear Int’l Divison; Latest Reviews

Read More About:

Source: Read Full Article