Billionaire fund manager Gundlach debunks ‘transitory' inflation

Is inflation transitory? Experts weigh in on the answer

Bianco Research President Jim Bianco, B. Riley National chief market strategist Art Hogan and Kaltbaum Capital Management President Gary Kaltbaum weigh in on the Federal Reserve, inflation and today’s economic and market trends.

Billionaire bond fund manager Jeffrey Gundlach worries the manufacturing sector is flashing signs that inflation will be more than just "transitory."

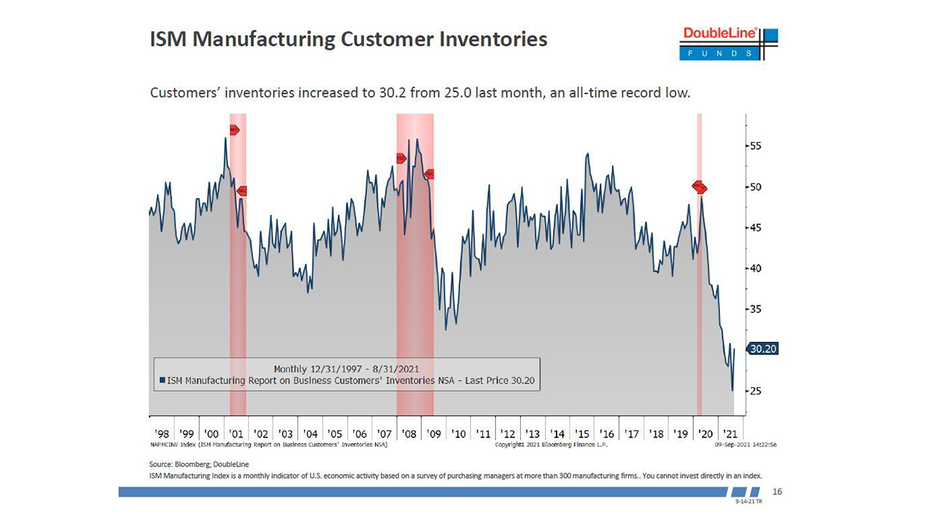

Inventories remain at a "very, very low level," Gundlach, CEO and chief investment officer of Los Angeles-based DoubleLine Capital, which has $137 billion in assets under management, said during a conference call Tuesday evening. "This is not supportive of inflation being transitory."

FOX Business reached out to Gundlach for further explanation but did not receive a response.

WALL STREET HIKES EXPECTATIONS FOR SIZE OF BIDEN'S SPENDING PACKAGE

The Institute for Supply Management’s customer inventories reading rose 5.2 points in August to 30.2. ISM said the reading was "too low," which is "considered a positive for future production."

Source: DoubleLine Capital Customer inventories plunged to an all-time low earlier this year as lockdowns aimed at slowing the spread of COVID-19 shuttered factories, resulting in materials shortages and supply chain disruptions. Industries ranging from semiconductor chips to lumber and diapers have been impacted by the shortages. Low customer inventories, especially during periods of elevated inflation, lead to even higher prices because retailers have to pay more for their merchandise. Those higher prices are then passed along to customers. Consumers are already grappling with the highest inflation in 13 years. The consumer price index in August rose 5.3% annually, slowing fractionally from the fastest pace since 2008. ALUMINUM PRICES SOAR IN NEW CONSTRUCTION HEADACHE Additionally, core personal consumption expenditures (PCE), the Federal Reserve’s preferred inflation measure, rose 3.6% in July, the most on an annual basis in 30 years. Core PCE has held above the Fed’s long-stated 2% inflation target for five straight months, the longest stretch since the seven months from March 2018 to September 2018. The central bank in August 2020 tweaked its policy, saying it would allow inflation to run "moderately" above 2% "for some time" in order to help the central bank meet its goal of full employment. However, resurgent inflation has begun to make Fed members uneasy. Chairman Jerome Powell admitted during his Jackson Hole symposium speech that inflation at these levels is a "cause for concern." Powell also stated that should the economic recovery evolve as expected, many Fed members, including him, think it would be appropriate for the central bank to start tapering its asset purchases later this year. Still, he warned that scaling back those purchases would not be a "direct signal regarding the timing of interest-rate liftoff." Traders of 30-day federal fund futures at the Chicago Mercantile Exchange are pricing in the first interest rate hike to occur in January 2023. GET FOX BUSINESS ON THE GO BY CLICKING HERE "I don't think the history books will say inflation was transitory," Gundlach said. "The Fed seems to want to believe transitory means maybe nine months and we're getting close to the end of that nine months. Source: Read Full Article