Singapore manufacturing activity remains upbeat, expands for 12th straight month

SINGAPORE – Manufacturing activity stayed on the boil in June to record a 12th straight month of expansion.

The sector has led the country’s recovery amid the pandemic and is likely to remain the key driver of economic growth in the coming months, analysts said.

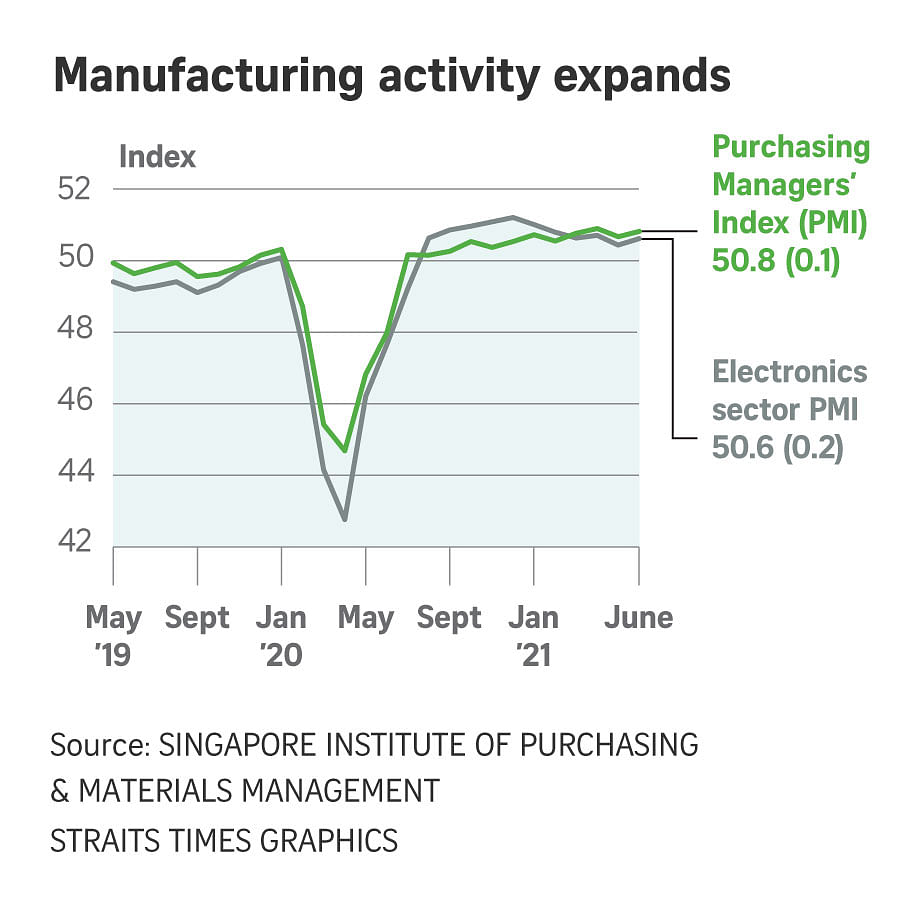

The Singapore Purchasing Managers’ Index (PMI) came in at 50.8 in June, a 0.1 point increase from the 50.7 in May, according to data on Friday (July 2). This was higher than the 50.7 forecast by economists in a Bloomberg poll.

A reading above 50 indicates expansion; one below points to contraction.

The PMI for the key electronics sector was 50.6, up from 50.4 in May and marking the 11th consecutive month of growth.

The electronics sector’s order backlog has also expanded for 12 straight months.

The Singapore Institute of Purchasing and Materials Management (SIPMM), which compiles the index, attributed the higher overall and electronics PMI readings in June to faster expansion rates in new orders, factory output and employment.

The overall employment index, which has recorded four months of continuous growth, came in at 50.5 last month.

Ms Sophia Poh, vice-president of industry engagement and development at SIPMM, noted that the manufacturing economy ended the first half of the year on a positive note, with the employment index for the electronics sector recording an eighth straight month of expansion.

“However, local manufacturers are concerned about the different variants of Covid-19 that could restrict economic activity and disrupt supply chains,” she said.

UOB economist Barnabas Gan pointed to the risk of higher inflation, noting that overall input prices rose to 51.1 – the highest level since November 2019 – while electronics input prices increased to 51.8, the highest since September 2018.

These factors could spill over to consumer prices, he added.

OCBC Bank head of treasury research and strategy Selena Ling pointed out that rising raw material and input prices, along with increased Covid-19 curbs to combat higher infections, have contributed to a pullback in many regional manufacturing PMI readings.

Singapore may not be immune to these supply chain disruptions and input price pressures, she warned.

Manufacturing PMI in the likes of Malaysia, Indonesia and Thailand fell in June on a month-on-month basis amid the resurgence of Covid-19 cases.

Barclays regional economists noted that multiple headwinds could hinder manufacturing in Asia in this half of the year, especially given the uncertainty around the pandemic.

Incremental weakness in China’s manufacturing – official PMI fell for a third consecutive month in June – will gradually be felt through the region, they said.

Join ST’s Telegram channel here and get the latest breaking news delivered to you.

Source: Read Full Article