U.S. Housing Starts Unexpectedly Show Continued Slump In June

After reporting a steep drop in new residential construction in the U.S. in the previous month, the Commerce Department released a report on Tuesday unexpectedly showing a continued decline in housing starts in the month of June.

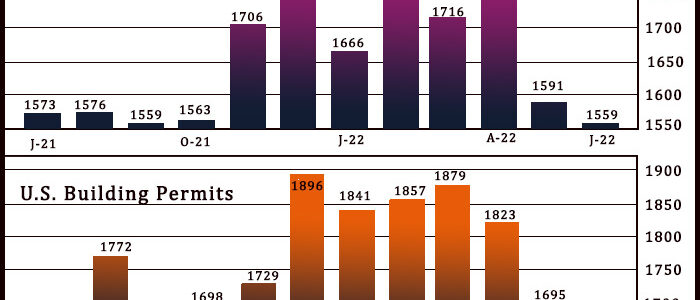

The Commerce Department said housing starts slumped by 2.0 percent to an annual rate of 1.559 million after plunging by 11.9 percent to a revised rate of 1.591 million in May.

The continued decrease came as a surprise to economists, who had expected housing starts to jump by 2.3 percent to an annual rate of 1.585 million from the 1.549 million originally reported for the previous month.

With the unexpected decline, housing starts dropped to the lowest annual rate since hitting a matching rate in September 2021.

Housing starts continued to fall as an 8.1 percent nosedive in single-family starts more than offset a 10.3 percent spike in multi-family starts.

The report showed building permits also fell by 0.6 percent to an annual rate of 1.685 million in June after tumbling by 7.0 percent to a rate of 1.695 million in May.

Building permits, an indicator of future housing demand, were expected to slump by 2.7 percent to an annual rate of 1.650 million.

The smaller than expected decrease in building permits came as an 8.0 percent plunge in single-family permits was partly offset by an 11.5 percent surge in multi-family permits.

“We expect housing starts to lose some momentum as 2022 progresses, but the June starts data and the July plunge in homebuilder sentiment suggest a clear downside risk to our forecast,” said Nancy Vanden Houten, Lead U.S. Economist at Oxford Economics.

The National Association of Home Builders released a separate report on Monday showing a substantial deterioration in U.S homebuilder confidence in the month of July.

The report showed the NAHB/Wells Fargo Housing Market Index plunged to 55 in July from 67 in June. Economists had expected the index to edge down to 66.

The HMI showed its second biggest single-month drop after a 42-point nosedive in April 2020, tumbling to its lowest level since May 2020.

Source: Read Full Article