U.S. Import Prices Inch Up Much Less Than Expected In September

The Labor Department released a report on Friday showing U.S. import prices inched up by much less than expected in the month of September, although the report also showed a bigger than expected increase in U.S. export prices.

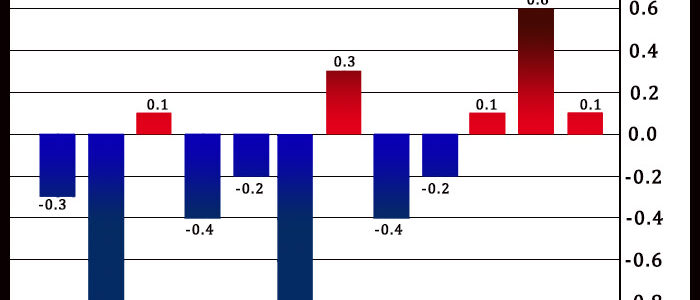

The report said import prices crept up by 0.1 percent in September after climbing by an upwardly revised 0.6 percent in August.

Economists had expected the pace of import price growth to match the 0.5 percent increase originally reported for the previous month.

The uptick in import prices reflected a continued surge in prices for fuel imports, which spiked by 4.4 percent in September after soaring by 8.8 percent in August.

Excluding fuel, import prices slipped by 0.2 percent for the second consecutive month amid lower prices for foods, feeds, and beverages; non-fuel industrial supplies and materials; capital goods; and automotive vehicles.

The report said import prices in September were down by 1.7 percent compared to the same month a year ago, as prices for fuel imports plunged by 8.9 percent and prices for non-fuel imports slid by 0.8 percent.

“Declining import prices for consumer goods and auto parts should minimize the risk of a resurgence in consumer inflation,” said Jeffrey Roach, Chief Economist for LPL Financial.

He added, “Despite the disappointing CPI release yesterday, the Fed will likely keep rates unchanged in November as financial conditions tighten organically from the recent spike in bond yields.”

Meanwhile, the Labor Department said export prices advanced by 0.7 percent in September after jumping by a downwardly revised 1.1 percent in August.

Export prices were expected to climb by 0.5 percent compared to the 1.3 percent surge originally reported for the previous month.

The bigger than expected increase in export prices came as prices for non-agricultural exports shot up by 1.0 percent, more than offsetting a 1.1 percent slump in prices for agricultural exports.

Export prices in September were down by 4.1 percent compared to the same month a year ago, reflecting the smallest year-over-year decline since February.

Source: Read Full Article