Georgia Runoffs Will Yield Mixed Bag for Stocks Whoever Wins

Tuesday’s U.S. Senate runoffs in Georgia will bring benefits and losses for stock investors, no matter who wins.

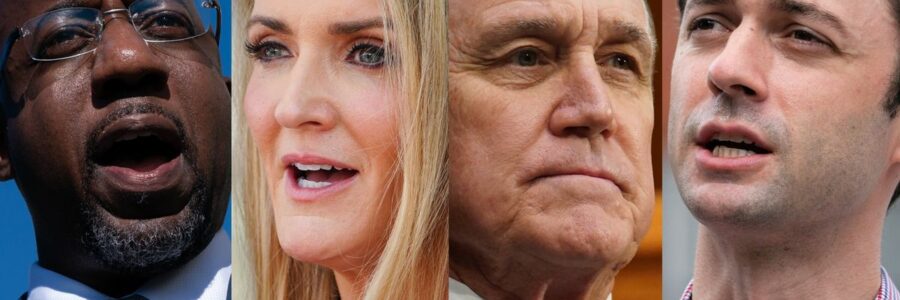

The two Republican incumbents will face their Democratic challengers after none of them clinched majorities in November. If both Democrats win, their party will control Congress and the White House in 2021.

AnRBC survey of 75 institutional investors in December found that 88% believed the GOP will retain control of the Senate, with 56% saying that would be bullish or very bullish for stocks. Last week, Height Capital Markets cut its odds for a Republican win of at least one seat to a “straight tossup” of 45% to 55%, citing early voting favoring the Democrats and “Republican dysfunction” surrounding stimulus checks and the 2020 election results.

“The scale and scope of fiscal policy in 2021 will be determined by the voters of Georgia,” Cowen analyst Chris Krueger wrote in a late December note. If Democrats win both seats, President-elect Joe Biden’s $3 trillion “Build Back Better Plan is in play. If not, $1 trillion is probably the ceiling,” including a $300 billion highway bill, he said.

Mixed Bag

Investors are going to get a mixed bag no matter what, according to Kristina Hooper, Invesco’s Chief Global Market Strategist.

“If both seats go to the Democratic party, that dramatically increases the chances of more stimulus,” Hooper said by email. “However, a Democratic sweep brings with it the potential for higher taxes.”

A Democrat-led Senate would help Biden’s broader agenda and be positive for green energy and negative for traditional energy stocks, she said. Health-care providers would likely get a boost, while biotech and pharmaceutical companies could take a hit, given that Biden will try to strengthen the Affordable Care Act while targeting drug prices. Construction and materials would be set to gain with a greater likelihood of infrastructure stimulus, she said.

A Democratic sweep would result in a “powerful internal market rotation” as investors reposition for more government spending, some taxes, green policies and more regulation, according to Evercore ISI strategist Krishna Guha. If Republicans hold at least one seat — which is Guha’s most likely scenario — then the last big hurdle of political uncertainty will have been cleared, giving investors a run at trading a vaccine-led recovery, backed by more government spending and very accommodative monetary policy, the strategist wrote in a note on Monday.

The U.S. “will be a friendlier place” for international trade, no matter who wins, which will help exports, John Augustine, Huntington Private Bank’s chief investment officer, said in an interview. That would mean likely gains for industrial companies, banks, financial services firms, as well as auto makers and parts companies.

No Tax Increases

Amherst Pierpont Chief Economist Stephen Stanley foresees no tax hikes or big infrastructure spending whatever the outcome.

Stanley also predicted there would be no more stimulus if Republicans hold one of the Georgia seats and retain narrow control of the Senate, which he said is the “outcome that financial markets are pricing in.” If that’s the case, “we have seen the last of the mega‐packages from Congress,” he said.

Compass Point analyst Isaac Boltansky sees a “macro narrative split” if the GOP holds the Senate, with a smaller stimulus effort, which would be negative for stocks, offset by unlikely tax increases, which would be positive.

‘Small Blue Wave’

In the event of a “small blue wave,” he said stocks exposed to housing affordability would probably benefit, including manufactured-housing firm Sun Communities Inc., apartment real estate investment trust Mid-America Apartment Communities Inc., homebuilder D.R. Horton Inc. and mortgage insurer Essent Group Ltd.

Boltansky also sees potential that a strengthened Consumer Finance Protection Bureau would put pressure on overdrafts, small-dollar lending and credit bureaus, which might impact firms like Regions Financial Corp., OneMain Holdings Inc. and Equifax Inc. He said there may be discussion of financial transaction taxes, which could hurt companies such as Nasdaq Inc. and MarketAxess Holdings Inc., though those changes would face an “uphill climb.”

Even if Democrats win both seats, they would hold the slimmest of majorities — 50-50, with incoming Vice President Kamala Harris casting deciding vote. And while the party would control both chambers on Congress, the Democrats’ edge in the House slipped to 10 seats, so they’re also working with the barest of margins.

The outcome in Georgia is also likely to influence Biden’s nominees for financial regulatory agencies, according to Bloomberg Intelligence. A “Republican-controlled Senate would likely oppose candidates overly unfriendly to the financial industry,” analysts Elliott Stein and Nathan Deanwrote.

Dean alsosaid that “Democratic wins may boost the chances of targeted tax hikes affecting technology companies while increasing broadband regulation. Consumer-financial companies could see faster implementation of new rules. Yet banks may potentially serve marijuana-inspired businesses faster.”

Source: Read Full Article