As Biden takes massive approval rating hit, White House moves to act on inflation

Biden’s inflation plan leaves the Federal Reserve in ‘terrible’ position: Holtz-Eakin

Former Congressional Budget Office director Douglas Holtz-Eakin weighs in on high inflation rates and strategizes practical solutions on ‘Cavuto: Coast to Coast.’

After a year of relentlessly rising prices, the White House is finally shifting to full inflation-fighting mode, with officials fanning out across cable news in an attempt to staunch the political bloodbath as President Biden's approval rating plunges.

The administration has taken steps to quell voter unrest over surging inflation by signaling that Biden understands what U.S. households are enduring — and that officials are maximizing efforts to bring prices under control — ahead of the November midterms, in which Democrats risk losing their already razor-thin majorities.

HIGH INFLATION COULD BE 'PAINSTAKINGLY SLOW' TO COME DOWN

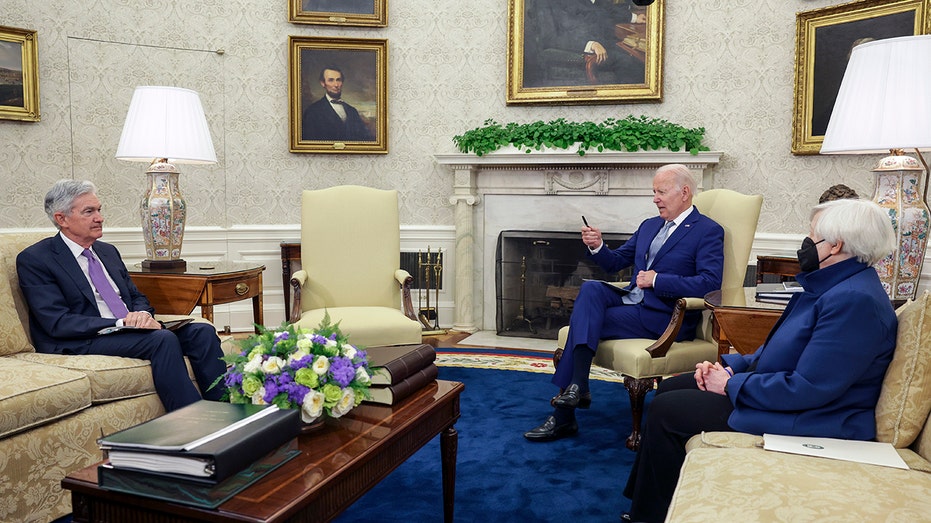

Just this week, Biden held a rare Oval Office meeting with Federal Reserve Chairman Jerome Powell, wrote an op-ed in the Wall Street Journal about his plan to tackle higher prices and sent his top lieutenants, including Treasury Secretary Janet Yellen, across cable news to tout his plan.

U.S. President Joe Biden (C) meets with Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen, in the Oval Office at the White House on May 31, 2022 in Washington, DC. (Kevin Dietsch/Getty Images / Getty Images) Biden called tackling inflation his "top priority" while meeting with Powell, though he also sought to deflect blame over soaring prices, saying that fighting inflation largely falls under the purview of the Federal Reserve. The White House has increasingly tried to shift the responsibility for tackling prices to the Fed — as polls show that inflation, which has hovered near a 40-year high for months, is a top concern for voters. "My plan is to address inflation. That starts with a simple proposition: Respect the Fed, respect the Fed’s independence, which I have done and will continue to do," Biden said. US ECONOMY ON CUSP OF STAGFLATION, WORLD'S LARGEST HEDGE FUND WARNS The meeting is just part of a months-long blitz planned by the White House, designed to emphasize the historic level of job creation and the low unemployment rate during Biden's first 17 months in office, as well as plans to put more money into Americans' pockets. The U.S. economy recorded its strongest growth in nearly four decades in 2021, fueled by trillions in government stimulus and easy monetary policies that kept borrowing costs near zero. While the pandemic relief efforts helped keep households afloat during the pandemic and helped to bring unemployment from a high of 14.7% down to 3.6% in just two years, it also fueled rapid consumer demand that has exacerbated already sky-high inflation. A Labor Department reported last month that the consumer price index jumped by 8.3% in April, underscoring that inflationary pressures in the economy remain very strong. On top of that, gas prices hit another a record high on Thursday, with a gallon of gas on average now costing $4.71 — up 40% from just one year ago. Most economists now expect elevated prices to persist throughout the year, worsening the political headache for both Biden and the Fed. A Gallup poll released Tuesday showed that just 14% of Americans rate economic conditions as "excellent" or "good," while nearly half — 46% — call them "poor." Another 39% have said the economic landscape is "only fair." That's down from one month ago, when 20% of Americans rated conditions as good and just 42% said they were good. The president has drawn flak, along with the Federal Reserve, for referring to inflation as transitory for months, even when it became clear the inflation spike was likely to last longer than expected. Biden has repeatedly blamed the price spike on supply chain bottlenecks and other pandemic-induced disruptions in the economy, as well as the Russian war in Ukraine. Republicans have pinned it on the president's massive spending agenda. When price increases continued, even as Democrats expected them to slow, the White House pivoted and started arguing that Democrats' massive Build Back Better spending bill would help address cost pressure. But Sen. Joe Manchin, D-W.Va., has squashed that legislation, leaving Democrats spinning to find another defense against inflation. Administration officials have since conceded they did not expect last year to unfold as it did. "I think I was wrong then about the path that inflation would take," Treasury Secretary Janet Yellen said Tuesday during an interview on CNN. "There have been unanticipated and large shocks that have boosted energy and food prices, and supply bottlenecks that have affected our economy badly that I… at the time, didn’t fully understand." US President Joe Biden speaks during a visit to a family farm in Kankakee, Illinois, US, on Wednesday, May 11, 2022. (Taylor Glascock/Bloomberg via Getty Images / Getty Images) It remains to be seen whether Biden's new strategy on the economy will prove effective with voters. It comes at an increasingly precarious time for the U.S. economy, as the Fed moves at the fastest pace in decades to raise rates and crush inflation. Policymakers voted last month to lift the short-term interest rate by 50-basis points and have all but promised that similarly sized hikes are on the table at upcoming meetings. There are growing fears on Wall Street the Fed may drag the economy into a recession with its inflation battle: Bank of America, as well as Fannie Mae and Deutsche Bank, are among the Wall Street firms forecasting a downturn in the next two years, along with former Fed Chairman Ben Bernanke. Powell has acknowledged there could be some "pain associated" with reducing inflation and curbing demand but has pushed back against the notion of an impending recession, identifying the labor market and strong consumer spending as bright spots in the economy. Still, he has warned that a soft landing is not assured. CLICK HERE TO READ MORE ON FOX BUSINESS "It's going to be a challenging task, and it's been made more challenging in the last couple of months because of global events," Powell said recently during a Wall Street Journal live event, referring to the Ukraine war and COVID lockdowns in China. But he added that "there are a number of plausible paths to having a soft or softish landing. Our job isn't to handicap the odds. It's to try to achieve that." Source: Read Full Article