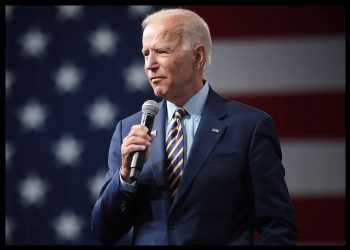

Biden To Speak On Actions To Strengthen Confidence In Banking System In The Wake Of Bank Failure

President Joe Biden will deliver remarks Monday morning on actions that his administration has taken to strengthen confidence in the U.S. banking system in the wake of the collapses of Silicon Valley Bank and Signature Bank.

In a statement issued on Sunday, Biden said that at his direction, the Treasury Secretary and the National Economic Council Director worked diligently with the banking regulators to address problems at Silicon Valley Bank and Signature Bank.

Biden added that they reached a prompt solution that protects American workers and small businesses, and keeps the U.S. financial system safe. The solution also ensures that taxpayer dollars are not put at risk.

The American people and American businesses can have confidence that their bank deposits will be there when they need them, according to the President.

Biden said he is firmly committed to holding those responsible for this mess fully accountable and to continuing his administration’s efforts to strengthen oversight and regulation of larger banks “so that we are not in this position again.”

“Tomorrow morning, I will deliver remarks on how we will maintain a resilient banking system to protect our historic economic recovery,” Biden said.

Earlier, the U.S. finance authorities had announced plans to limit the fallout from the collapse of Silicon Valley Bank. The U.S. Treasury and Federal Reserve in a joint statement announced decisive actions to protect the U.S. economy by strengthening public confidence in the banking system.

The statement said that the Silicon Valley Bank depositors will have access to all of their money starting Monday, and that no losses associated with the resolution will be borne by the taxpayer.

Silicon Valley Bank had a dramatic collapse on Friday after many depositors withdrew their money, anticipating the bank’s possible failure in the near future. A Venture capital fund “Founders Fund” reportedly withdrew all its funds from Silicon Valley Bank.

Following this, the bank’s assets were seized by the U.S. finance authorities due to inadequate liquidity and insolvency. The California Department of Financial Protection and Innovation appointed the Federal Deposit Insurance Corp. or FDIC as receiver of Silicon Valley Bank.

Source: Read Full Article